Last Updated on March 12, 2024 by Lukas Rieder

Presumed Market Developments and Planning

The basic engine from the post “Early Warning and Planning” shows that order intake is the most important factor for sustainable success and has consequences for almost all planning and control areas. Market-related early warning means analyzing and assessing the factors influencing order intake in the medium and long term and their interdependencies. These factors include disposable income, the behavior of competitors and the interest of retailers in actually promoting the products and services they offer.

The most important factor in attracting new customers, however, is the customer benefits offered by the company’s own offerings compared with those of its competitors.

Analysis of customer benefit

To receive an order requires that a customer (or a group) decided to buy the offer. Thus it is the customer who decides about the relevant criteria and their respective weight according to his needs.

If you want to improve the planning and management of your organization and make it successful in the long term, you have to know from your offerings (products, services) how well they meet the criteria used by customers. The better the customer’s purchase-deciding criteria are met, the more the company sells. This knowledge can be gained through customer benefit analysis.

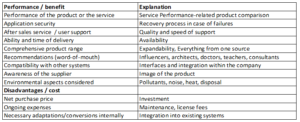

The purpose of a customer benefit analysis is to find out, which criteria future consumers apply when they decide for my offer or for another one. To do so, customers compare the benefits, performance and advantages (benefits) of a procurement option to its disadvantages, acquisition price, current expenditures in their application (cost). Then they rank the different opportunities to decide. The result is a cost-benefit-analysis for each examined option.

If such an analysis is consistently prepared from the buyer’s point of view it has the central advantage for salespeople, managers and controllers that it includes all aspects relevant to the buyer and also assesses the competitors. Thus it covers nearly all marketing aspects. The possible procurement variants are compared regarding:

If an organization can afford to outsource the preparation of a customer benefit analysis, there is a good chance that the main competitors will appear in the analysis and be fully assessed from the customer’s point of view. Our experience shows that even a less expensive analysis carried out by an organization’s own staff can yield significant insights. The prerequisite, however, is that the interviewees are repeatedly reminded to take the perspective of a potential customer.

In the book Customer Orientation in Innovation, Marketing, Sales and Leadership, Markus Orengo provides guidance on how to conduct a customer benefit analysis. He has also developed an Excel-based tool that provides step-by-step support for setting up the analysis and also presents the results graphically for decision-making purposes.

Overall market influences on order intake

Other factors of market activity, which a customer benefit analysis cannot depict, can become early warning information:

-

- Conditions for resellers (i.e. dealers, craftsmen, doctors, software importers)

- Sales and turnover development of competitors

- New products, which could harass the own portfolio

- International trade restrictions / tariffs / import or export bans

- Development of new international standards which could prevent the sale of own products

- Disposable income of the demanders / economic situation (can I afford it?).

Points 1. and 2. require the observation of the competition. However, the information usually comes late, as it is obtained by interviewing resellers or through publications. It is therefore important that the company’s own sales staff also use their customer contacts to find out about purchases made by their customers from competitors and to document the information afterwards in the internal reporting system (CRM system).

As markets become mature, mergers and acquisitions often occur as the large vendors try to increase their market share and thereby improve their cost position. Such events also have an early warning character. This is because they often occur in such a way that in mature markets, 5 – 6 groups worldwide hold 70-80% of the market shares and thus dictate the market rules (e.g. automobiles, personal computers, operating systems, cell phones). In such situations, the smaller companies often have to reinvent themselves and launch new products and applications to survive.

Information on mergers, sales trends, new technologies and products, trade barriers, and government regulations (items 3 – 6) provide important inputs for adjusting a company’s own policies and strategies. Decision makers must interpret the data and take it into account when revising plans.

One starting point for containing the effort and time required to obtain this kind of external data is it to subscribe for the services of a media monitoring agency that is individualized for the company’s own issues. This way of obtaining early warning data can also be used in research and development fields or for tracking disposable income.