Last Updated on March 12, 2024 by Lukas Rieder

Management Accounting and Managerial Decisions

Managers decide on the people to be employed, the procedures, the capacities, the market presence and the results to be achieved. In their respective management areas, they are responsible for the results. A management accounting system must therefore be designed that each manager can see for his area of responsibility what the direct consequences of his decisions will be or have been.

What do managers decide?

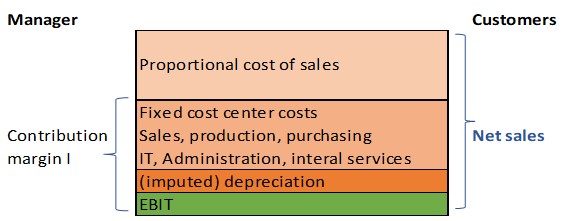

Customers decide whether to place an order or not. If an order is placed, the product, quantity, price, conditions and delivery date are recorded. This information defines gross and net revenue of the order. Based on the bills of material and routings as well as on the planned purchase prices and proportional cost center rates, the proportional planned costs of the order can be calculated.

The difference between net revenue and proportional costs is the contribution margin I of the order (not the cost of sales).

To execute the order, managers must ensure that the company is operationally ready to perform. The equipment must be ready for operation, the personnel must be available and ready and the technical and procedural requirements must be met. Managers are thus responsible for the company’s readiness to perform and for the resulting costs. They decide which personnel, which facilities and which internal services must be available so that production and sales can take place.

Decision-relevant management accounting

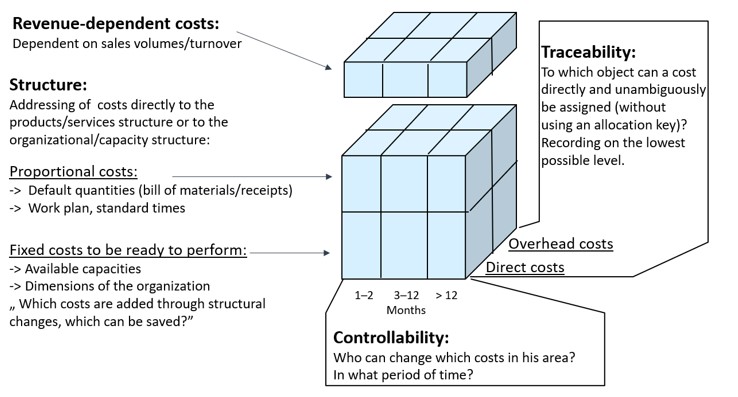

To enable managers to make decisions and to take responsibility for the results, three dimensions of costs and revenues must be represented simultaneously in management accounting:

Proportional and fixed costs

Proportional costs are causally necessary to produce a unit of a product or a service. According to the bill of materials a given product or service unit consumes material and/or external services. According to the work plan this product also consumes cost center services. The valuation of these consumptions with the planned purchase prices and the proportional planned cost rates of the cost centers results in the proportional planned product costs. These are the only costs directly caused by the produced unit.

Fixed costs are given by the capacity and the structure of the organization. This is also true for most depreciation costs because most equipment becomes technologically obsolete faster than it could be used. Fixed costs are the complement of proportional costs:

Total costs – proportional costs = fixed costs.

Controllability of costs

If a manager wants to change costs in his area, he must know in which time period these costs can be influenced. Hourly paid employees usually have a shorter notice period than permanent employees. Contracts with suppliers can also be concluded for shorter or longer periods. The basis for depreciation of fixed assets only changes when the asset is replaced or taken out of service. Both proportional and fixed costs may have different time periods for them to be affected.

Traceability of costs

All cost and revenue documents are to be assigned to the lowest competent and thus responsible hierarchy level (customer, production or research order or cost center). This is also where costs can be directly influenced. Direct cost assignment to the lowest possible level also accelerates and simplifies the management process (delegation principle).

Cf. Controller Dictionary, p. 146

Proportional costs are directly caused by the product or service manufactured or by services explicitly asked from other cost centers.

Fixed costs are incurred for the organization’s readiness to perform. They are always assigned to a cost center because the manager of the cost center is responsible for them. Therefore, the allocation of fixed costs to a single unit manufactured or sold is not accurate.

The main purpose of management accounting is the planning and control of revenues and costs by the managers directly responsible for them. These persons must know which influencing variables they can control on their own responsibility. Requirements from tax laws and accounting standards (US GAAP, IFRS) are not relevant in management accounting because the focus is on corporate management, not on external reporting.

We have implemented this management accounting-system for many years with the help of German Grenzplankostenrechnung GPK (or Resource Consumption Accounting RCA) and of stepwise contribution accounting. This combination of instruments works in manufacturing, trading and service companies as well as in selected public administrations. Our intention is always to serve all managers with decision-relevant information for their area so that they can take responsibility for the results.