Last Updated on March 12, 2024 by Lukas Rieder

Beating Inflation

“Beating Inflation” is the title of the book by Prof. Dr. Hermann Simon, the “old master” in price management and profit control, published in 2022. This publication deals with the demands that the currently again rampant inflation places on corporate management. Many of his statements are also essential inputs for the design of a comprehensive management control system and thus for the sustainable success of a company. In this and in the next two posts of this blog, his insights will be combined with the design of the comprehensive planning and control system of a company.

After a period of about 40 years with hardly any significant inflation rates, Europe and the entire English-speaking world are affected by massive price increases as a result of the COVID pandemic and war-related events. Many managers are experiencing inflation intensely for the first time and need to understand how to plan and act in such a situation in order for their companies to survive successfully.

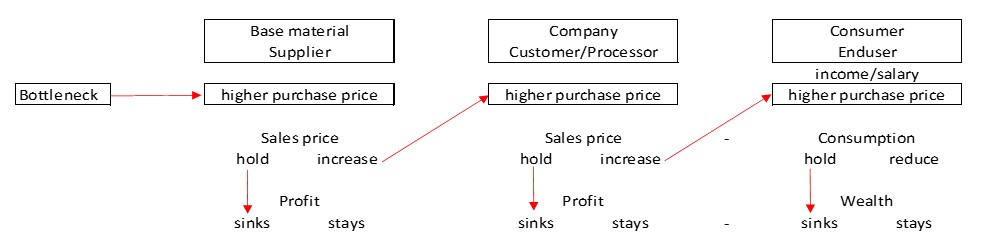

How price increases propagate

Generalizing, price increases are the result of bottleneck situations. Bottlenecks can arise in various areas when demand is greater than available supply. Insufficient supply capacity is often due to:

-

- Raw material availability in the required qualities too low

- Lack of transport capacity or transport containers

- Political/legal supply restrictions

- Inability to comply (yet) with regulations on manufacturing processes or guarantees of origin

- Insufficient personnel capacity for processing and handling

- Too little equipment available for manufacturing or insufficient manufacturing capacity

- Too much capital investment ris equired for manufacturing.

Such bottlenecks lead to cost increases for suppliers of material and services. They try to pass on the cost increases to their customers in the form of higher net selling prices. If this succeeds, the purchase prices for the (further) processing companies rise. These price increases must in turn be passed on to the next (production) level. If a company cannot successfully pass on its higher costs, it will sooner or later incur losses, become insolvent and go bankrupt.

At the end of this chain are the end customers, usually private individuals. If purchase prices rise for them, they consider which of the available products and services they will continue to buy, taking price increases into account. This is because they only have their disposable assets and regularly recurring income available for consumption. Customers usually opt for what they consider to be the best price/performance ratio.

Suppliers at all levels try to circumvent, delay and keep price increases as low as possible in purchasing by means of negotiations or changing suppliers. In sales, the aim is to pass on the price increases that have occurred. Whether this is fully successful depends on the preferences of customers on the one hand and on the behavior of competitors on the other.

In order to remain successful in inflationary times, one’s own company must succeed in interrupting the price increase spiral. Inflation is thus a challenge for all employees, because all functional areas are affected, and above all the entire management. Countless ideas for improvement have to be generated, evaluated and decided upon. Furthermore, the interruption of the inflation spiral has to happen quickly, because otherwise the financial result will suffer. Above all, the following must be adjusted:

-

- The assortment to be offered and the assortment width

- The pricing process from gross price to net revenue

- The marketing, customer acquisition and sales processes

- The distribution channels and the definition of target customers

- The product development and design

- The manufacturing processes and the input materials to be used

- The purchasing process and the choice of suppliers

- All administrative processes

- The data integration and the automation of administrative processes

- The investment planning as a result of the process changes.

Professor Simon estimates that most companies can only pass on about 50% of the inflationary cost increases on the procurement side to the customers; the entire cost side in the company must also make a contribution to the profit defense (p. 191).

The next post will go more into detail on which measures have how strong an impact on profits.