BCG-matrix and the life cycle

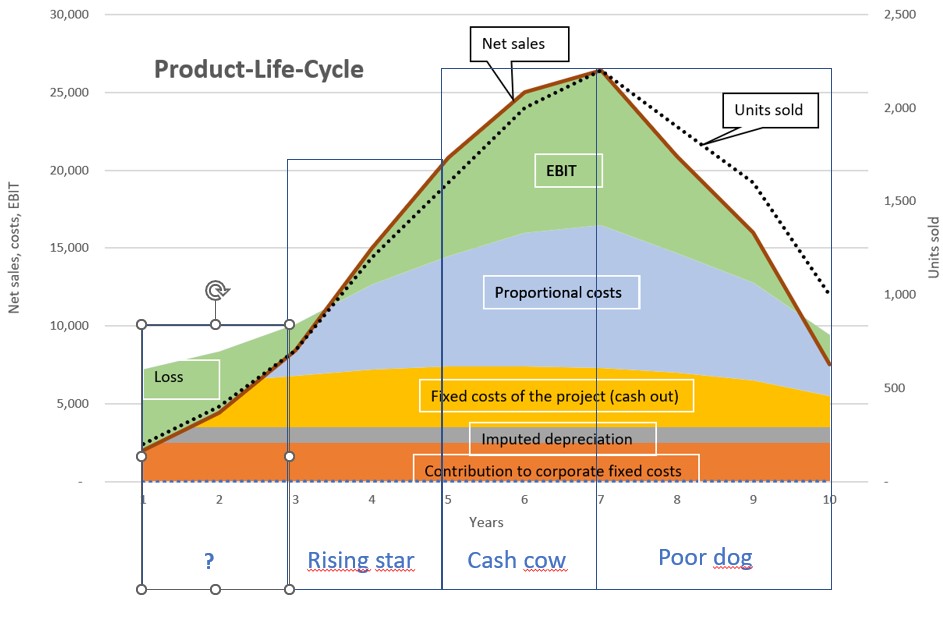

The four phases of a product or market according to the BCG-matrix can usually also be recognized in the life cycle of a product:

-

- If a company achieves initial sales and turnover success with a new product or a new product group, it is not yet clear whether it will become a success. It is still a question mark.

- If sales volumes and turnover increase more strongly than in the previous year (the curve is always steeper), this is a rising star. It is possible that not all costs are covered at the beginning of this phase, but the contribution margins are growing faster than the fixed costs. The product enters the profit phase.

- The cash cow phase begins when the annual sales growth rates decrease compared to the previous year. Profits reach the highest absolute values, which also increases liquidity. Owners can be paid higher dividends or new question marks and stars can be financed.

- The start of the downturn phase (poor dog) cannot be precisely defined. If the competition also records lower sales volumes, the downturn is probably already underway. In such a situation, it is important to know whether contribution margins are still being generated to cover the fixed costs of the product or sales area. If the contribution margins are tending towards zero, the product must be removed from the range as it no longer contributes financially to the company’s success.

-

BCG-Matrix in the life cycle

Effects on financial solvency

The BCG matrix also provides an important insight into a company’s liquidity:

Question marks and stars tie up liquidity (available cash) because

-

- more sales lead to higher accounts receivable,

- higher inventories are required for timely delivery,

- investments in fixed assets have to be paid for.

Cash cows and poor dogs free up liquidity because

-

- there are hardly any new investments to be paid for in the business area,

- due to falling sales, accounts receivable balances also become less,

- less inventory needs to be financed in order to fulfill orders on time.

The combined use of the BCG-matrix and of the dynamic investment calculation is particularly recommended for strategic and medium-term operational planning. The focus is on the profitability of the targeted product/market positions. However, it is also to clarify whether the projects can be financed from the company’s own funds or whether external liquid funds will have to be procured.