Precalculation of a Strategy Implementation

A product/market strategy should help to increase company value. The calculations in the post “Quantifying the draft strategy” are not sufficient for the strategic decision because

-

- the estimated quantities and the net revenues per sales area and product for the intended strategy period are still missing,

- information on proportional material and external service costs for the new products or services to be offered is missing (bill of materials of the items to be assessed),

- for the new products or services it has not yet been determined in which cost centers which unit-related processing steps are to be carried out (work plan per new service or new product),

- it is not clear yet for the new products which additional fixed costs will be required for the sales, production and support areas (cost center plans),

- the necessary investments in buildings, equipment, vehicle fleet or rights and licenses are not yet taken into account.

This data is preferably created in the ERP-system and in the management accounting system because the data structures and historical values are already available there:

-

- If customers, products, sales quantities, prices and sales deductions as well as bills of materials and routings are stored in the ERP-system, the new products can also be created in these data structures.

- In management accounting the cost center plans with their personnel and machine capacities, the proportional cost rates and the fixed cost blocks are available. This allows to calculate the proportional production costs of the new products or services.

- The deciding managers must be able to build on this database because they will be responsible for the success of the strategy.

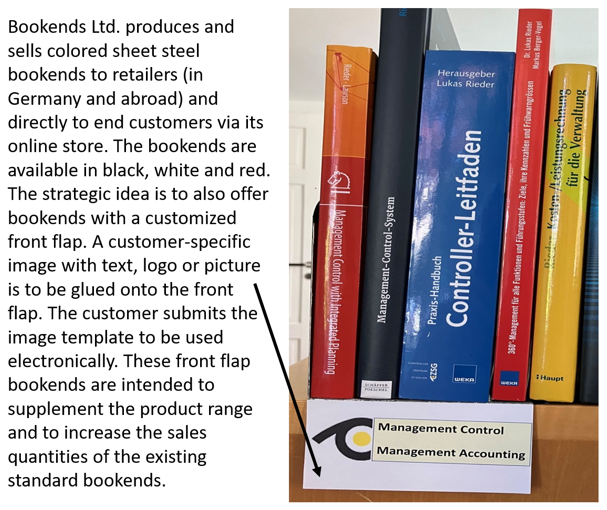

The procedural steps for quantifying the implementation project of a strategy are developed in the example below. It must be shown whether the production and sale of individualized bookends for private or public libraries can increase the value of the company.

Intended manufacturing process

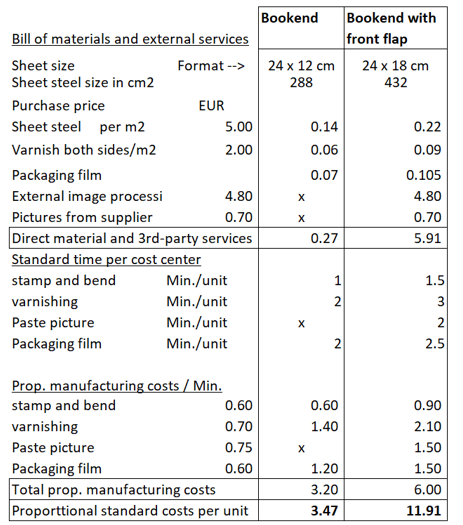

The starting material for the standard bookends are 1 mm thick and 12 cm wide steel coils. Sheet metal plates with a length of 24 cm are punched from the coils and are bent into a 12 cm wide and 12 cm high bookend. The bookends are then painted black, white or red and individually wrapped in a transparent protective film.

For the intended front flap bookend 18 cm wide steel coils are required because the front flap should be 6 cm high and 12 cm wide. Punching a front flap bookend will result in sheet metal waste of 6 x 12 cm per piece. The coil supplier can recycle this waste.

The area to be painted increases by 12 x 6 cm per unit compared to the standard version, i.e. by 25%. The front flap bookend can be punched, coated and packaged on the existing machines.

The front flap is customized using an image template of the customer’s choice submitted electronically. The “image processing” cost center is to be set up for this purpose. It should take on the following tasks:

-

- Checking the images submitted by e-mail for the front flap and sending the order to the external printer of the self-adhesive images

- Gluing the returned foils onto the bookends front flap.

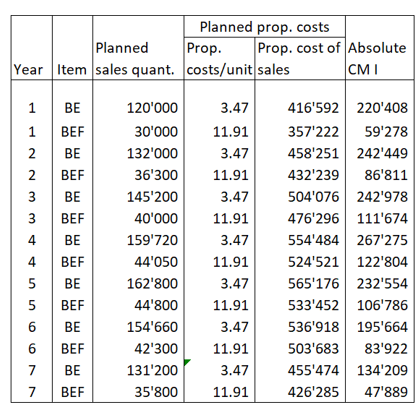

It is advisable to create the bill of materials and the work plan for the intended front flap bookend in the ERP system, as almost all the materials to be used and the processing cost centers are already available in the system. Based on this data the planned proportional costs of the existing and of the new front flap bookend can be calculated:

With this calculation the strategy deciders recognize which costs are directly caused by the production of the bookends. The planned proportional costs per unit are a key prerequisite for assessing whether the introduction of the new product will lead to higher company profits.

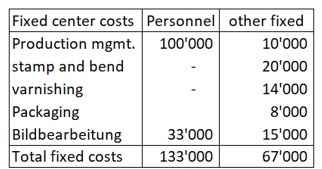

The annual fixed costs of the production and image processing cost centers were estimated (excluding depreciation and interest) and recorded as a planning basis in management accounting:

These fixed costs are also relevant to the strategy assessment.

Net revenue planning

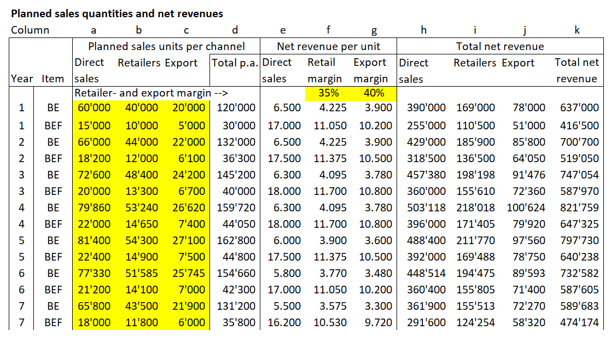

Together with product management, the sales organization considered how many units per product could be sold annually in the sales channels (direct sales, sales via dealers in Germany and exports). In doing so, they did not focus on the manufacturing costs, but tried to estimate the sales prices that potential customers would be willing to pay for the individualized front flap bookend by means of competitor comparisons.

They also estimated how the life cycle of the products might develop. The experience curve shows that both the sales quantities and the net revenue per unit decrease towards the end of the life cycle due to market saturation and the market entry of imitators.

The expected quantities per sales channel (columns a-c, yellow boxes) and the expected net revenue (columns e-g) were estimated for an expected product life of 7 years and entered in the table. It had to be taken into account that domestic and export dealers will require a margin share of gross sales to cover their own efforts (columns f and g). The expected net revenue of Bookend Ltd. is shown on the right-hand side of the table (rows h-k), BE = Bookend, BEF = Bookend with front flap.

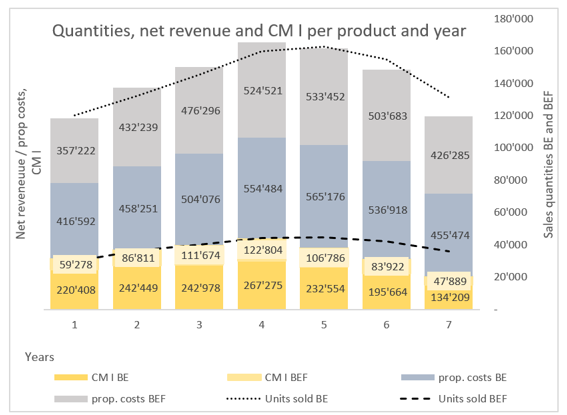

Planned development of absolute contribution margins

The proportional production costs of the two types of bookends were deducted from the planned net revenue (column k above). To simplify matters, it was assumed that the proportional product costs per unit will not change over the strategy horizon. This resulted in the absolute contribution margins I per item to be expected annually.

In the following graph the expected annual absolute contribution margins I from bookends BE and front flap bookends BEF are highlighted in yellow. These must cover the additional fixed costs, the investments and the target profit of the strategy.

These annual contribution margins must cover the additional fixed costs and investments listed below:

-

- Additional fixed personnel costs of EUR 100,000 are expected annually and beginning in year 3 in bookend production because more production orders will have to be processed and more operational personnel will have to be supervised.

Increasing production volumes will require investments in production facilities:

-

- Year 0 (before the start of production of front flap bookends): Adaptation of the punching and bending system, approx. EUR 90,000.

- Year 0: Installation of the system for positioning and gluing the front flap images, approx. EUR 60,000.

- Year 2: Addition of a heating tunnel to the paint shop for approx. EUR 80,000. The heating tunnel reduces the drying time and thus increases the capacity of the paint shop by 40%. The processing times per unit will remain the same as before.

As these cash outflows for additional fixed costs and investments are expected in different years, the time value of money must be considered when deciding on a strategy. This is done in the next post with the help of the dynamic investment calculation.

Is it worthwile to do this detailed planning?

Definitely! If the described clarification of the strategic project were to cost EUR 100,000 in personnel costs (3-6 months of work) but would lead to a rejection recommendation, this amount would be much smaller than the outflow of funds that would result from an unsuccessful strategy implementation.