Job Satisfaction

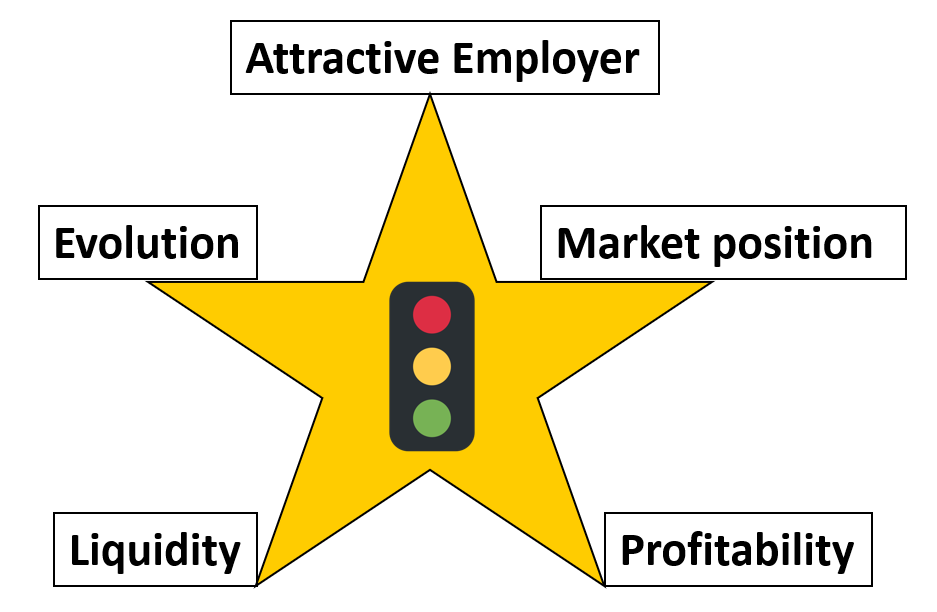

Job satisfaction greatly increases employer attractiveness.

According to the Swiss Federal Statistical Office FSO, more than 100’000 job vacancies were available in the first quarter of 2022 – primarily in the industrial and service sectors. In particular, the rising trend of a lack of skilled workers is causing concern in many places. In the wake of this worsening shortage of employees it is worth paying increased attention to job satisfaction in the Top Control “Employer Attractiveness“.

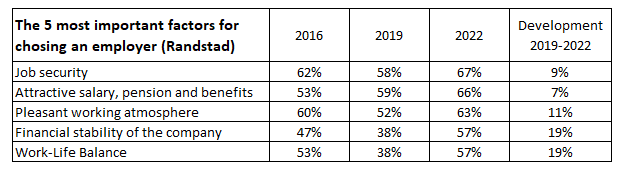

Many companies now employ a large number of experts to identify and attract good new employees and retain them in the long term. Corresponding HR processes have long since found a place on the strategic maps of many companies. Initiatives range from “active sourcing,” to “finder fees” for employees or the abolition of application letters, to in-house mindfulness trainers, initiatives in corporate health management, flex-work offers or vacation purchase programs.

These offers may have their justification and certainly support the retention of employees in a company. In my experience, however, they now tend to have the quality of “hygiene factors” – especially for high-performing and marketable (knowledge) employees – and are thus part of the mandatory program of every company. There is hardly any real differentiation here anymore.

Managerial behavior

As a rule, employees are seldom dissatisfied because the fruit basket or the table football box in the office are missing. Statistics show that the behavior of the direct supervisor contributes significantly to job satisfaction. A survey of almost 3,000 persons confirmed that 62% of all respondents had already quit once because of their supervisor(s) (cf. Information Factory, 2014).

Managerial behavior of direct supervisors is the key factor of employer attractiveness.

However, my experience shows that people-related lmanagement tasks are still neglected in many companies. Many managers at all hierarchical levels only devote themselves to their employees when,

-

- the performance appraisal interview is imminent,

- employees in their own management area attract negative attention,

- cooperation does not work as desired,

- new rules and processes are introduced in the company,

- costs are to be reduced or processes are to be changed.

Because adjustments to changing requirements are part of normal everyday life in any company, it is important to continuously support ones own employees in such a way that they can deal with these changes and still enjoy their tasks. One starting point for this is “psychological empowerment.”

Psychological empowerment

Referring to the statistics on internal employer attractiveness (Factors of Internal Employer Attractiveness (Trend Study Employer Attractiveness (topjob.de)), the managerial behavior of “psychological empowerment” is discussed here in more detail.

Empowerment means self-enabling, strategies and measures intended to increase the degree of autonomy and self-determination. The purpose is to give employees more possibilities to shape their interests and their social environment themselves.

Studies show that psychological empowerment goes hand in hand with a particularly proactive attitude towards work (see Spreitzer G. (1995). Psychological empowerment in the workplace: dimensions, measurement, and validation. Academy of Management Journal, 38, 1442-62.)). It was also shown that psychological empowerment is associated with greater job satisfaction and higher performance as well as with stronger retention and commitment (see. Seibert, S. E., Wang, G., & Courtright, S. H. (2011). Antecedents and consequences of psychological and team empowerment in organizations: A meta-analytic review. Journal of Applied Psychology, 96, 981-1003).

Similarly, positive evidence on employees’ mental health and innovation behavior has been demonstrated (Chermuly, C.C. (2023). Empowerment: strengthening and developing employees. In: Felfe, J., van Dick, R. (eds) Handbook of employee leadership. Springer Reference Psychologie, Springer, Berlin, Heidelberg.).

The approach assumes that four work-related factors constitute the experience of psychological empowerment (see Spreitzer, 2008):

-

- the experience of competence (occupational self-efficacy)

- meaningfulness (meaningfulness and intrinsic motivation, i.e. motivation coming from within)

- self-determination (autonomy in the execution of activities)

- influence (degree of power that employees assume during the performance of the activity, belief in the ability to influence one’s own work results).

Relationship design is central

Psychological empowerment requires trust, employee orientation and appropriate organizational communication. Furthermore, it can be influenced by targeted and clearly defined personnel development processes and offers, meaningful work design, strength-oriented use of competencies, and specific person-related managerial practices (different for each employee).

The focus is on building a relationship with each collaborating person. People and their individual perspectives must become the focus of managerial behavior. Only then can genuine empowerment take place – instead of excessive demands or the rigid pursuit of command chains. This requires above all time, an appropriate attitude and a conscious and competent use of specific discussion techniques (including active listening, questioning techniques, coaching elements) from the respective manager.

In my experience, these basic requirements are still neglected in many organizations. We often hear phrases from managers such as, “People management is important to me but I don’t have time for it.” Those who do not perceive relationship building as a priority and elementary management task will therefore hardly be successful in the long term. Only those who take the perspectives of employees into account and involve the persons in their own team individually will benefit from the positive effects of psychological empowerment and thus make a “real” contribution to internal employer attractiveness.

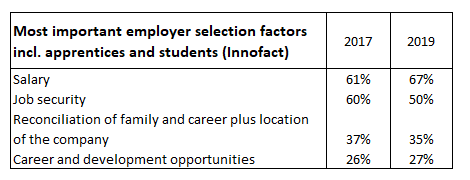

Employer factors for students and apprentices

Employer factors for students and apprentices