Strategy Development

In corporate management the term strategy is used for many different things. As a result, different approaches are recommended for developing a strategy.

Here the aim is to structure and execute the process of strategy development in such a way that plans for the medium-term development of a product/market combination are created and that the implementation results achieved can be assessed qualitatively and quantitatively. This is based on the definitions in the post “Strategy and Functional Concepts“. In particular, the definition of a unique selling proposition (USP) according to Michael Porter is quoted there.

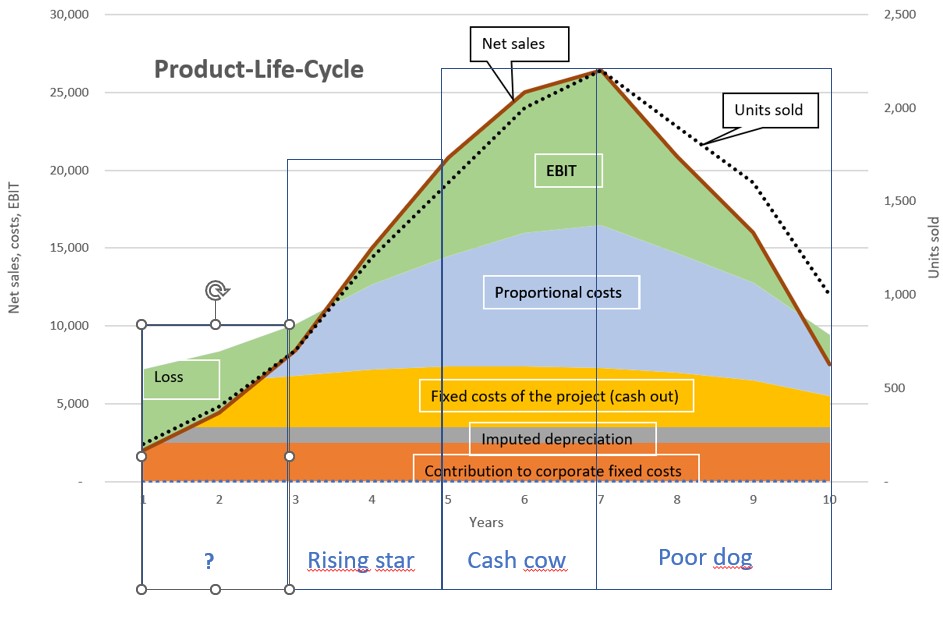

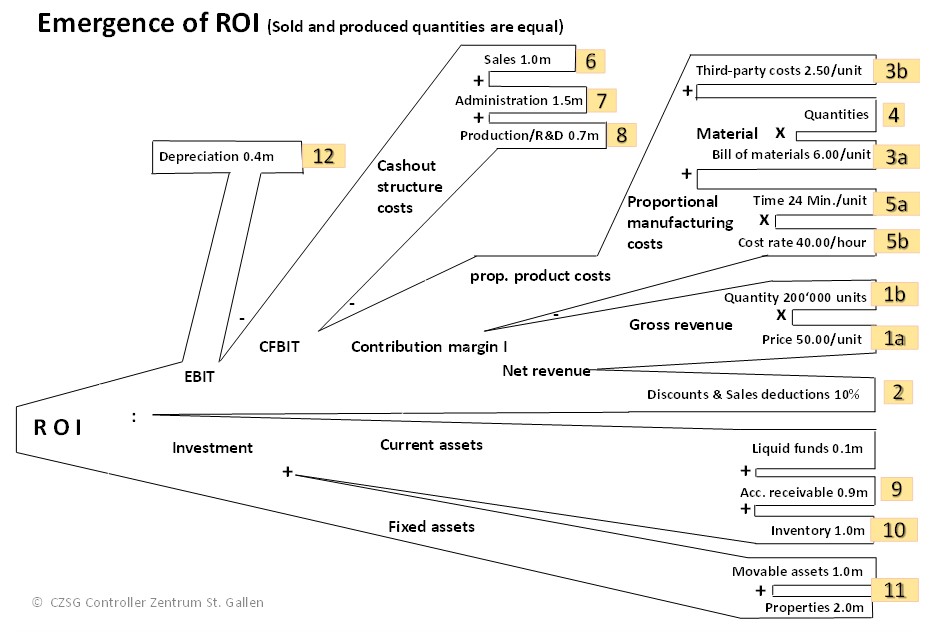

Most of our clients want to increase their market share with a strategy in order to achieve higher earnings before interest and taxes (EBIT).

This searching and fixing process cannot proceed in a straight line from the identification of objectives to the assessment of results because the results to be achieved are not yet fixed at the beginning. External and internal information must first be obtained, often only insufficient data is available and various internal participants in the process with different levels of knowledge and intentions have a say. This requires a multi-phase approach to processing questions and many feedback loops. Additionally, the composition of the processing team often changes during the discovery process.

In the process of developing and adapting strategies, the following questions usually need to be answered:

-

- Which product/market combination do we want to strengthen? (Strategic idea)

- How do we stand out from the competition (USP, from the customer’s point of view)?

- Who are our competitors, what turnover/market share do they achieve?

- Which services/products do we not have to achieve our goals?

- What internal developments are the prerequisites for success, or what knowledge and skills need to be acquired?

- How much investment will be required?

- Which employees do we lack

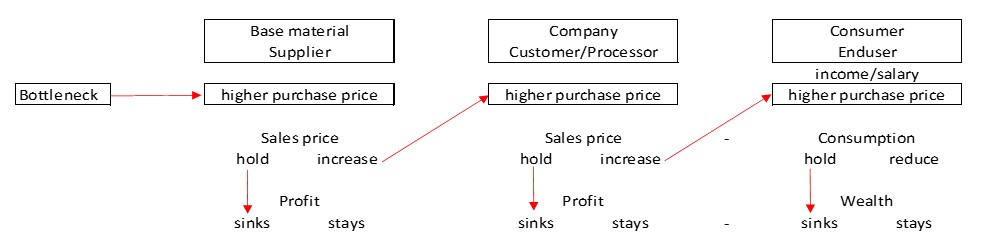

- What critical premises are contained in the above points that could prevent a successful strategy realization in the target markets? Examples: New legal regulations, political shifts, changes in consumer behavior, successes of competitors.

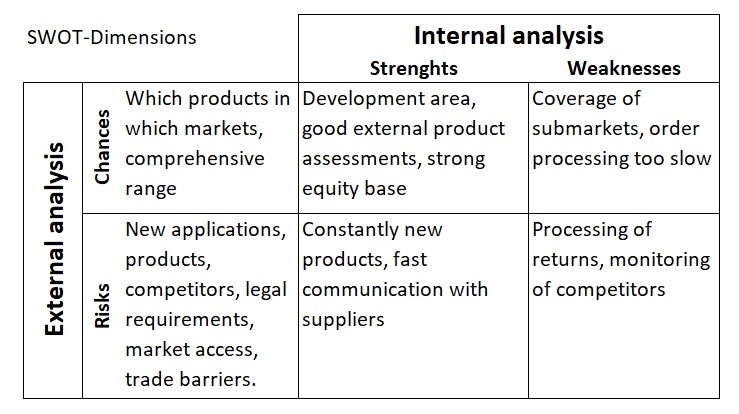

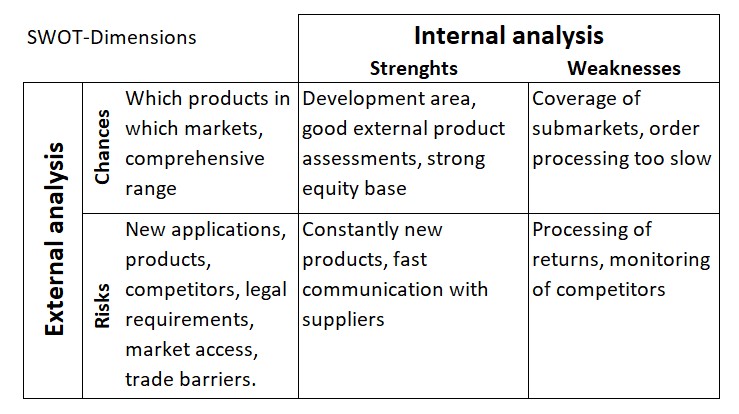

Points 1 – 3 are externally oriented, i.e. changes in the corporate environment must be observed and assessed. They can lead to the adjustment of strategic goals and plans

The status of points 4 – 7 must be determined within the company. The necessary developments must be derived from this.

If events occur during the implementation process that affect the critical premises (point 8), it must be analyzed whether the current strategic plan (points 1 – 3) needs to be adjusted or whether adjustments need to be made to points 4 – 7.

This requires regularly feedback throughout the process of strategy development and after the interim results have been established. They must lead to a decision as to whether the strategy implementation should be continued (go) or discontinued (no go).

From the strategy draft to the implementation project

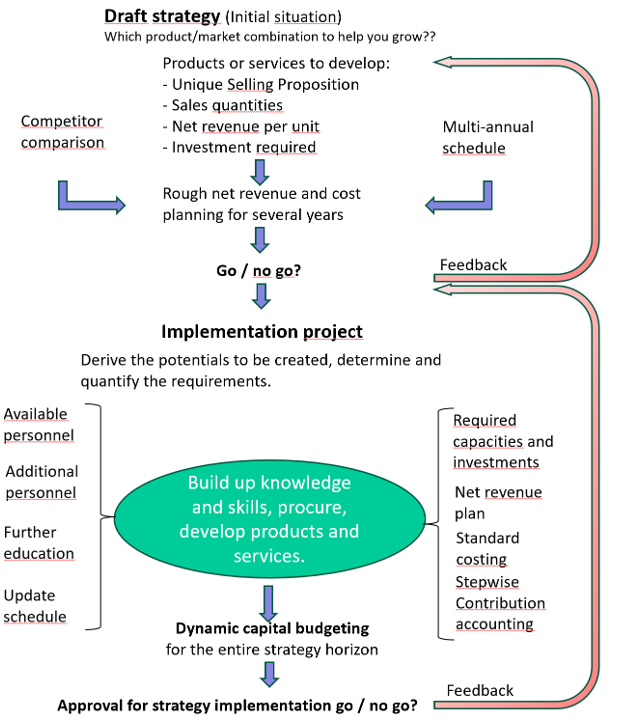

The flow chart below shows the path from the strategy draft (creative act) to the release of a strategic plan.

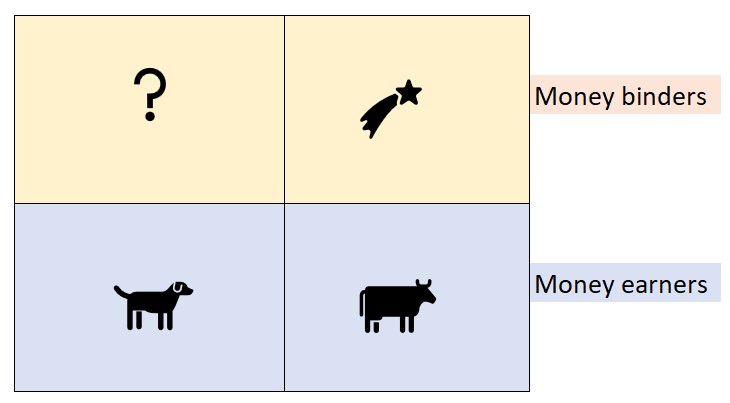

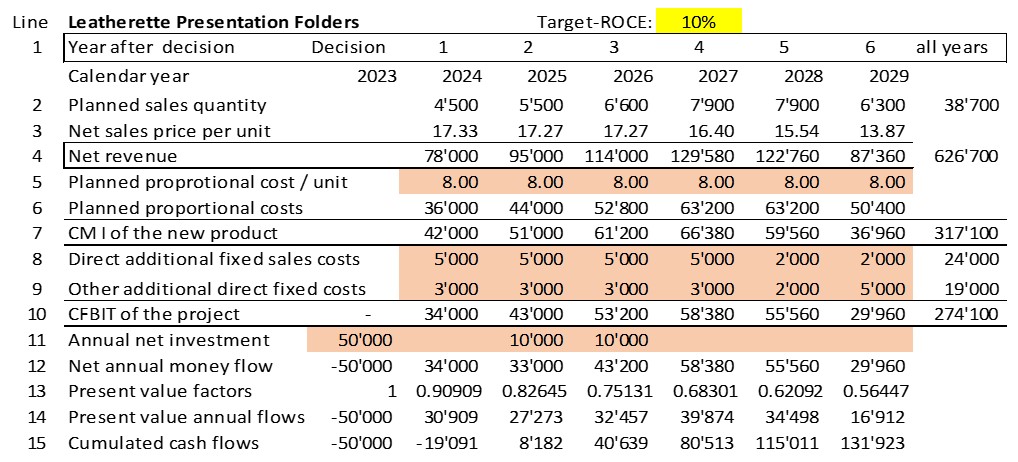

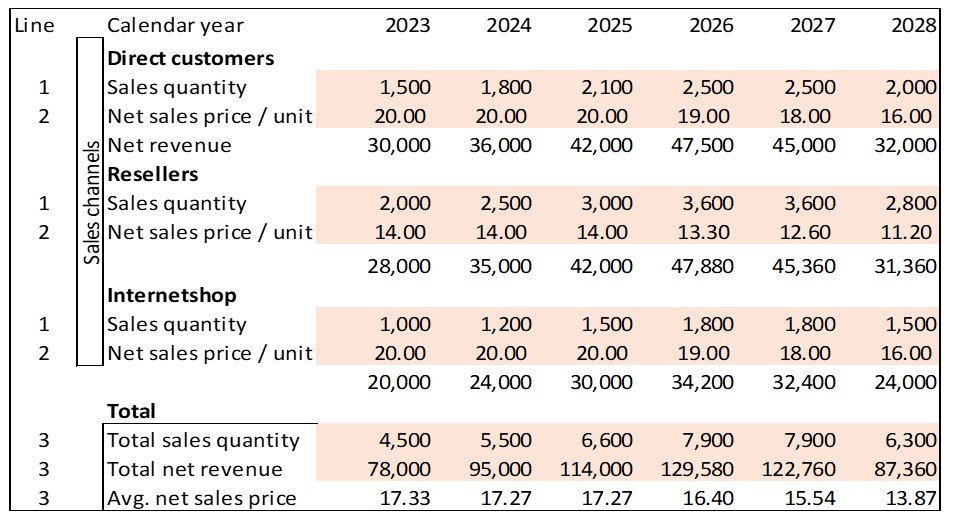

It starts with an idea of which products the company should use to gain market share in which (sub)markets in order to improve its own market position and profitability. The time horizon is usually several years and the behavior of the competition can prevent success. It is important to estimate the financial impact of the strategic idea as reliably as possible before investing time and money in the further development of the idea.

To tackle a promising strategy implementation project, it is advisable to estimate the achievable net revenue and follow-up costs of the strategic idea for the envisaged strategy horizon. These assumptions should be included in the strategy draft because they form the basis for the first go/no go-decision, namely whether the strategic project should be approved for development at all. It only makes sense to continue the project work if it is a “go”. The description of the unique selling proposition is also essential for this. This is because the decision-makers want to be able to recognize whether the strategy can create a USP before they place the order for the actual implementation project.