Last Updated on March 12, 2024 by Lukas Rieder

The planned sales should lead to invoiced turnover/sales and to the amount that will be available to the company to cover all costs and to make a profit, the net proceeds.

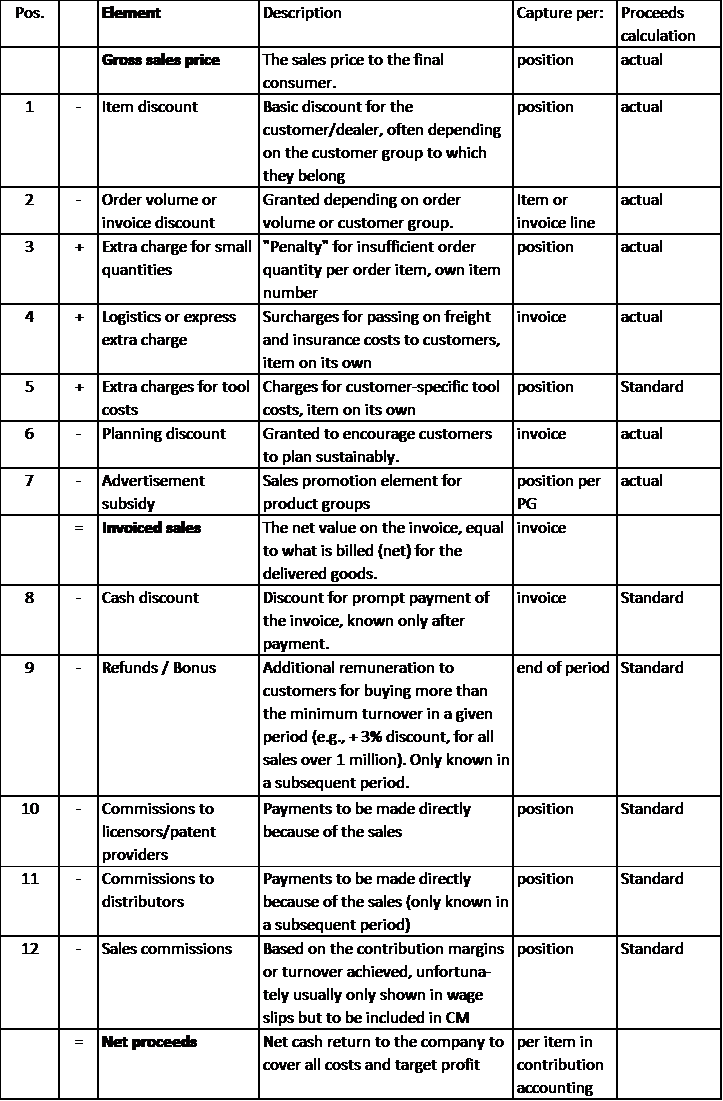

From Planned Sales to Net Revenue

Increasing division of labor between producers and distributors and the pressure on resellers’ margins mean that new types of sales deductions are being invented which reduce net revenue. The following table provides an overview of the more common types of deductions.

The Management Accounting system should be able to fully represent these types of sales deductions in both planning and actual data. To support decision-making, a distinction must be made between deductions (or surcharges) that directly influence the invoiced revenue and deductions that are granted from the net invoiced sales. Item discounts and invoice discounts can usually be assigned directly to the unit sold. Cash discounts, bonuses, and refunds are only determined after invoicing or even after receipt of payment. As a result, the relevant information is only available after monthly reporting, often long after the end of the year.

To ensure that the company does not “present itself too rich” during the year, we recommend recording the sales deductions at the planned rates (standards) and deducting them from the invoiced sales on a monthly basis. In addition, surcharges and deductions that are not directly item-related should be managed as separate “sales-items”, since, for example, a minimum quantity surcharge is usually calculated per order and therefore cannot be clearly assigned to the individual article. This applies analogously to express surcharges or advertising cost contributions.

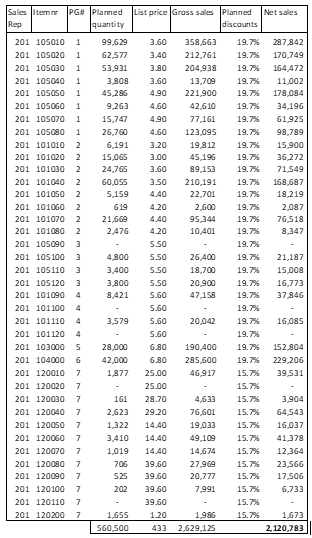

In the simulation model for the example company Ringbook Ltd., item-related discounts are granted from the recommended retail price. These discount rates are determined in planning for each combination of assortment affiliation (own products and trading goods) and customer group. In addition, invoice discounts are granted to encourage customers to place larger orders. These are granted in addition to the item discounts per customer group. Since the list prices and discount conditions are determined centrally, the individual salesperson cannot negotiate his own conditions with the customer.

If the billing documents are available, the invoice and item discounts granted are also known. However, this information is not yet known during planning. For this reason, the average discount rates granted in the prior year per product group are applied in the simulation model while planning.

In the example of Ringbook Ltd. no sales deductions based on invoiced sales are planned. Therefore, net sales also correspond to net revenue. The presented planned sales quantities and net sales are used in later posts concerning production planning and profitability analysis.