Link lean production and management accounting

Lean Production aims to reduce consumption of product-related working hours, input materials and externally sourced services, as well as the assets required for these, to the minimum necessary for the successful running of the business. The extent to which this can be achieved must be judged from a value-based perspective. This is why lean production and management accounting belong together.

This requires a management accounting that shows cost, activities, revenue and results. The system must be able to depict planned and actual values, variances, and forecasts for the individual item through all cost centers to the overall result in an activity-based manner. Management accounting is the collective term for this system. In management accounting, the success of lean management projects can be planned and tracked in terms of actual value.

Financial accounting only contains values but no activities that can be planned or tracked, cost allocation to products and services can only be done with the help of (arbitrary) allocation keys. Such a full cost allocation system is not qualified to support decision-making in lean management projects.

Management accounting must be structured as a standard cost system. This creates a symbiosis between lean management and value-based considerations because quantities and services are evaluated with monetary units and thus made synonymous.

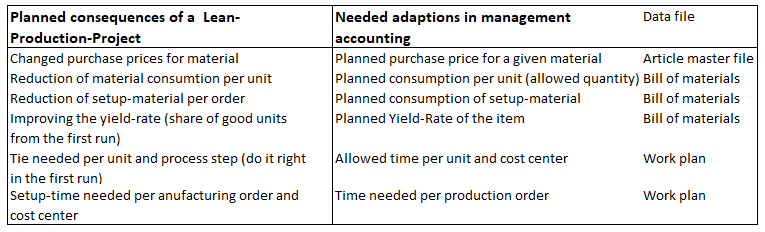

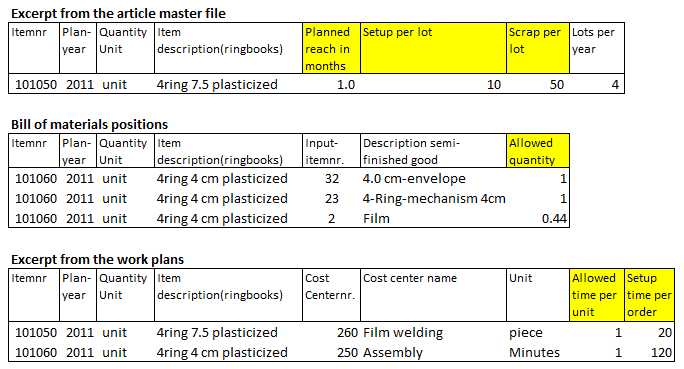

The new specifications resulting from lean production considerations (standard quantities, standard times, setup and setup times, scrap rates) are the quantitative basis for calculating the proportional standard costs of an item (target to be achieved). The planned material consumption and times resulting from the lean project are to be stored in various files:

Lean targets and cost accounting

In the managerial cost accounting system described in our book on Management Control, the planned times and quantities resulting from the lean project and directly related to the product are entered in the fields highlighted in yellow:

Transfer Lean target values to ERP

In the next plan year these activity-related objectives form the basis for the standard cost calculation of the planned proportional cost of goods manufactured. The resulting values then have a direct impact on the contribution margin calculation and on the planned profit and loss calculation, as well as on the value development of inventories.

If fixed cost center costs are reduced through the lean project, this does not change the proportional product costs (bill of materials and work plan remain the same). The adjustment of planned fixed values must therefore be made in cost center planning.

The different procedure for proportional and fixed costs is necessary because the fixed costs are never incurred for a product unit, but always in the cost centers. This is because fixed cost center costs are the result of the operational readiness of a cost center, not the activity performed. The cause of the operational readiness costs are always management decisions. If, for example, rooms are freed up for other areas as a result of a lean project, or if fewer personnel hours are required for cost center management, this is indeed a success, but whether this also results in a reduction in total costs only becomes clear when management decides to rent the room to someone else and to reduce the freed-up work capacity (lower headcount).

Charge only proportional costs to products

Therefore, it is important that in the cost accounting system only the planned proportional cost rates of the cost centers be attributed to products or other cost centers (cost splitting), both for the correct tracking of the progress of a lean project in terms of value and for the development of results in line with the period. The cost rates of the cost centers must not contain any fixed costs or allocations (see the post “Proportional and Fixed Costs”).

This also applies to internal activity allocation if service areas (research + development, laboratories, workshops, internal transportation, or IT) provide services for other cost centers or projects. Only if the recipient (receiving cost center) can either decide for itself whether it wants to obtain an internal service from another cost center or if there is an automatic link between the activity of the recipient and that of the service area, is it a case of genuine internal service charging. The proportional cost is charged to the recipient. In all other allocation cases, the term “fixed cost allocation” is appropriate.

For management purposes, it is advisable to always valuate in- and outflows in warehouses of products at planned proportional production costs only. This is because proportional costs are defined by the products manufactured, while fixed costs are period costs (e.g., month, year). They are charged to the period result regardless of the manufacturing and sales quantities. Successful lean projects usually result in a reduction of both proportional unit costs and fixed period costs. The reduction in unit costs also reduces the value of inventories, which in turn increases ROI.

Since the implementation of a lean project rarely coincides with a fiscal year change, the progress in the project’s start year must still be evaluated on the basis of existing planned costs. In management accounting, these improvements initially lead to positive cost variances that improve earnings.