Part of the consumer experience is that products, ignoring price changes due to inflation, are offered cheaper per unit over time, or that greater performance is offered for the same price.

Some examples:

In 1983, the Motorola Dyna Tac 8000x became the first commercially offered cell phone to hit the market at $3,995. Thirty years later, a cell phone with more features and no ties to a service provider can be purchased at a specialty retailer for about $20, or roughly 5‰.

The original IBM personal computer was introduced to the market in 1981 at a price of $1,565. Thirty years later, PCs were available for purchase for well under $100. These were also much more powerful than the original and offered more features. The HP LaserJet printer hit the market in 1984 at a price of $3,495. After about 30 years, laser printers were on sale around $100.

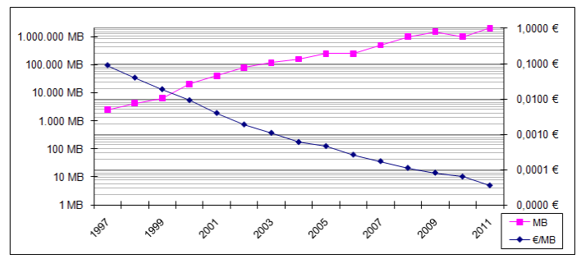

In https://winhistory.de, the development of the sales prices per megabyte of hard disk capacity from 1997 to 2011 is shown:

The fact that more output is offered for the same price over time can be observed in many areas of the economy. The main reasons for this are technological improvements, competition, and rising production volumes.

Improve cost position

A company must continuously strive to reduce its average total cost per unit of output. If it does not manage to do this, its existing or new competitors will do so, worsening its market position as well as the sales opportunities of the company.

A rapidly and continuously improved cost position is therefore a key prerequisite for achieving or maintaining a strong market position. Companies must be able to substantially reduce their average per unit costs of goods over time if they want to parry sales price reductions by competitors and maintain their profitability. Some of the companies that have managed this balancing act have become global corporations. Many others had to give up because they were not able to reduce the cost per manufactured unit to a sufficient extent.

These relationships have been known for a long time. As a result of his empirical investigations, B.D. Henderson presented the law of experience – also known as the experience curve or Boston effect – as early as 1974 (cf. B.D. Henderson, die Erfahrungskurve in der Unternehmensstrategie, Frankfurt/New York, 1974).

In the following posts, the determinants of the experience curve are first analyzed. It is then shown how the concept of the experience curve can be integrated into one’s own planning and control. The focus is on the alignment of internal objectives with external market developments.