«Schuetzengarten Brewery in St. Gallen/Switzerland (Ltd.) is the oldest independent and private brewery in Switzerland. It was founded in 1779. Despite cutthroat competition and market domination by a few large international breweries it manages to gain market share while remaining financially successful in the long term.

There are two main reasons for this development:

-

- The product range is continuously adapted to new customer needs; at international competitions, the brewery regularly wins top awards for its new products.

- The productivity of the operational processes is continuously improved in all areas, which naturally has a positive effect on profitability.

Investment Calculation for Handling Robots

In order to improve productivity, it had to be decided whether the investment in two handling robots for the barrel cleaning and filling would be worthwhile and how many years the benefits would have to flow until the cost savings would cover the investment and the respective interest costs.

Dynamic investment calculation is the instrument for the financial assessment of this decision.

Schuetzengarten Ltd. wanted to achieve the following benefits by using robots:

-

- Prevention of long-term physical damage to the employees working in the keg filling department (weight of the barrels (KEG) and number of movements).

- To proof pressure-safe filling, testing and sealing (quality assurance).

- To have sufficient filling capacity at all times, even for seasonal consumption peaks (at large events, beer is mainly served open, i.e. from KEGS)

- To be able to electronically measure the units of output provided and the condition of the equipment (preventive maintenance).

- To produce at a lower cost per output unit (different KEG sizes).

The investment amounts and the current expenditures for the operation (mainly electricity consumption and equipment maintenance) came from the suppliers’ quotations, the costs of the current employees in the KEG filling plant came from the cost center accounting or from the payroll administration. The qualitative and capacity requirements of points 2. – 4. are mandatory criteria to be covered in the offers of the potential suppliers. Higher fees for accident insurance and public liability insurance could possibly be added. However, this was not the case in the example described.

Investment and running costs

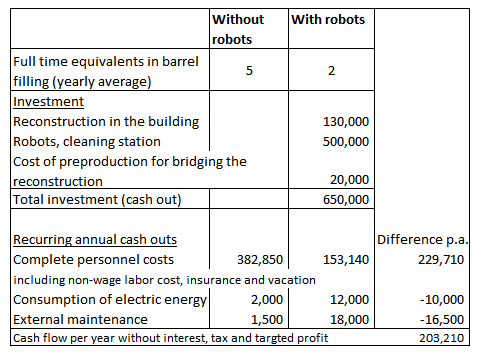

For the preparation of the decision, the controller of the brewery collected the following data:

The planned useful life of the investment is 15 years. The cash flows are divided into investment amounts to be paid at the beginning of the investment and the expected annual expenditures. The investment amount is posted to fixed assets and depreciated beginning in year 1 of use.

This overview shows already that the robot installation will be completely paid back after about three years, but can then be used for many more years.

In most companies, various investment projects with different planned useful lives compete for approval at the same time. To make the different durations and investment amounts of the projects comparable to each other, the time value of money has to be taken into account. The dynamic investment calculation achieves this by discounting the annual cash flows to the starting point.

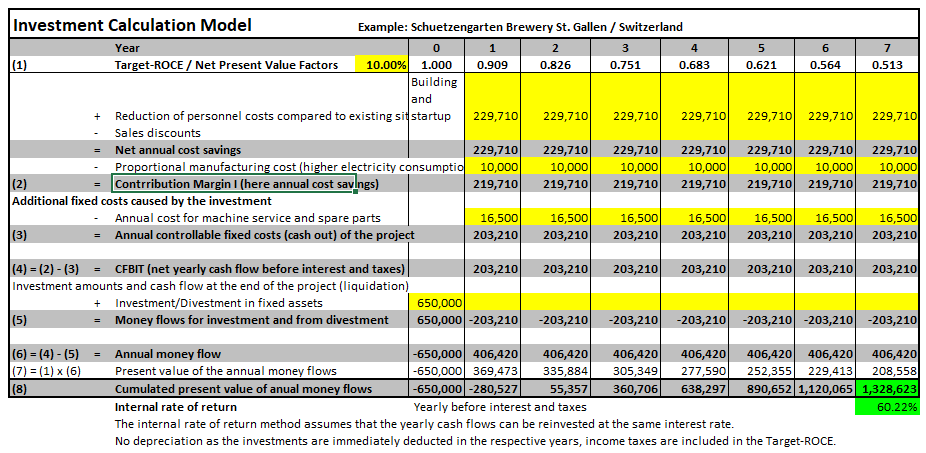

The investments and the current expenditures from above were entered into our generally applicable dynamic investment calculation model and led to the following result (the Excel model can be downloaded here together with the explanation of the application; all yellow fields can be changed):

If a target return of 10% before interest and income taxes is applied, it can be seen from (8) that the investment is paid back after two years.

Determining the required ROCE

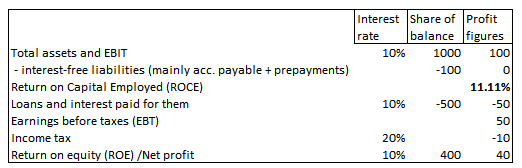

To determine the target rate of return to be applied, it is advisable to take the financing structure of the company into account and to start from the interest-costing capital (capital employed). The 10% assumed in the investment calculation model above can be adjusted in the model to suit the specific company.

An international comparison shows that, in the long term, a company must generate an annual return on capital employed (ROCE) of around 10% so that shareholders are willing to continue investing their money into the company (see the derivation and empirical findings for various countries in the book “360°-Management for all Functions and Management Levels Appendix B, p.243 ff.“).

In the numerical example, an EBIT (earnings before interest and income taxes) of 100 is achieved with an (operating) balance sheet total of 1,000, which corresponds to a ROI of 10%. Accounts payable and customer prepayments do not cost any interest, which means that the interest-costing assets amount to 900. The net capital employed thus generates a ROCE of 11.11%. The EBIT is used to pay interest on borrowings of 50 and income taxes of 10. The profit remaining for the shareholders is 40 and the equity capital used for this is 400. The return on equity is therefore 10%.

Investment calculation = pure cash flow analysis

When applying the investment calculation model, it is important to note that only the cash inflows and outflows expected as a result of an investment decision are taken into account. Depreciation has no place in an investment calculation since the expenditure for the investment is already included. Lower tax payments, if any, are also not relevant for investment decisions, since the definitive tax burden is only calculated on the basis of the profits actually incurred in a reporting year.

The investment calculation model presented is suitable for several purposes:

-

- Estimating the financial impact of strategic and medium-term operational decisions

- Comparison of the financial impact of competing investment projects and selection of those to be implemented

- Basis for the preparation of the medium-term (strategic) investment plan.

Conclusion

The “Schuetzengarten-Robots” are in operation. Watch the video

The investment decision was right, the expected benefits are continuously realized. The brewery has improved its competitiveness.

We wish the brewery continued sustainable implementation success.