Liquidity is essential for the survival of any organization at any time. That is why liquidity is one of the five top-controls (see the post “AMPLE for sustainable success“).

Liquidity

An organization is liquid if it is at all times able to execute all mandatory payments on time. If it fails to do so, it must by law declare its insolvency, which leads to bankruptcy proceedings and in most cases to the dissolution of the organization.

Consequently, solvency must be ensured at all times, both in the short term (day, month, year) and over several years, taking strategic developments into account.

Banks and similar institutions can become insolvent on a more or less daily basis due to large incoming and outgoing payments, because large outgoing payments can occur one or more days before the (re)receipt of expired loans. Thus, in banks, daily tracking of payment readiness planning is essential. In most other companies, monthly planning of cash flows is sufficient.

The scope of insufficient planning, monitoring and control of one’s own liquidity situation in a business context can be seen from the annual analyses of the Austrian credit protection association KSV 1870, https://www.ksv.at/PA%20Insolvenzursachenstatistik%20Unternehmen%202019. As a creditor protection association, KSV analyzes insolvencies in Austria (around 3,000 every year) and classifies them according to cause. The analysis for 2019 revealed the following order of insolvency causes:

-

- 42.6% are consequences of operational deficiencies (weaknesses in sales, financing and liquidity, planning and control systems)

- Around 21% are consequences of start-up errors (including lack of industry know-how, inexperience, insufficient business training, insufficient start-up capital)

- Around 10% are due to neglect of actual management duties.

According to the KSV findings, it is typically the boss who is responsible for insolvency and not the competition or the environment. This result holds true for young companies (up to 5 years old) as well as for longer existing organizations.

These statistically proven findings indicate that regular system-based planning and tracking of liquidity may not be neglected. The impact of short- and medium-term planning of quantities, activities, costs and net revenues on cash flows must be mapped so that correct and informed decisions can be made.

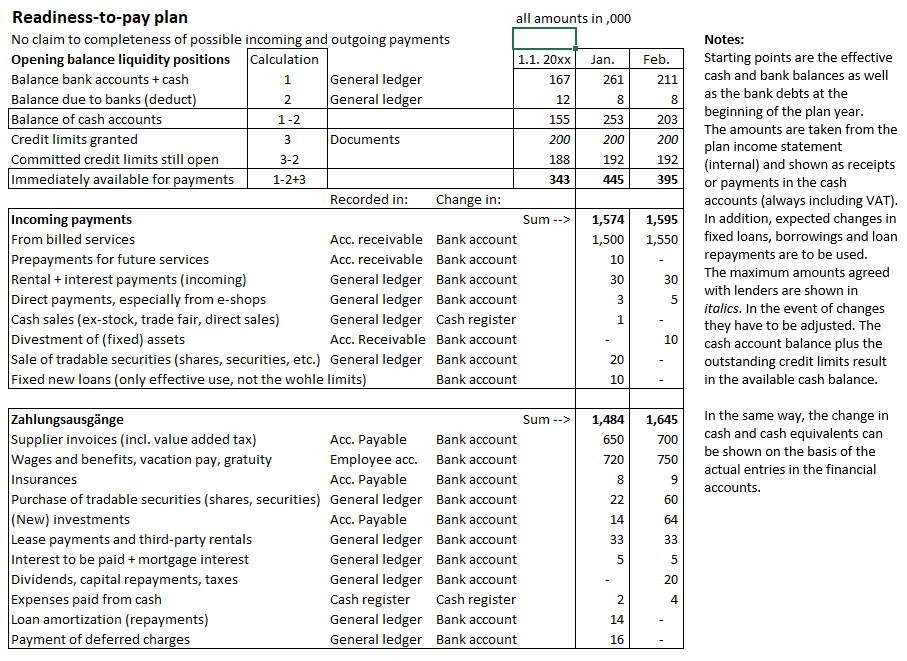

The following example illustrates how, and on the basis of which basic data, a monthly updated readiness-to-pay plan can be created. The initial data are, on the one hand, the immediately available cash and cash equivalents that will be in the books at the beginning of the planned year and, on the other hand, the planned profit and loss statement (planned P&L) of the upcoming year. Their creation can be traced in the simulation model for the book “Management Control System”.

From the planned sales, if the average duration between outgoing invoices and incoming payments is known, it is possible to calculate after how many days the invoiced sales lead to cash receipts (example: on average, customers pay 35 days after outgoing invoices). This means that January sales do not become cash until the second half of February). From the other items of the budgeted P&L, the cash outflows for wages, social benefits, raw material purchases and all other types of expenditures can be derived (the payment period granted by suppliers leads to a later outgoing payment). In addition, there are changes resulting from new investments, increases or decreases in inventories and expiring third-party loans, as well as payments for dividends and other distributions. These can be taken from the budgeted balance sheet (ibid.). A complete example of a willingness-to-pay plan can be found in the “Controller’s Guide”, p. 317ff.

If it is foreseeable that the stock of immediately available cash will tend towards zero, the CFO must ensure that banks or other lenders commit to providing corresponding additional funds. These are usually newly committed credit lines. The company will only use them when it needs them, since they cost interest. Committed credit limits are entered in italics in the corresponding line in the example model. This results in the amount of immediately available cash for each month end after taking into account all cash inflows and outflows of the planned month.

This plan can largely ensure that the organization remains solvent in the planning year. Exceptional situations, especially as a result of a drop in sales, can still occur. The Corona pandemic is an impressive example of this. The planning CFO must therefore consider how large the safety cushion should be to maintain solvency at all times. A proven rule of thumb is that the entire personnel costs including social benefits plus the average accounts payable balance of two months can be paid from the immediately available cash. From the numerical example, it can be seen that this safety cushion does not yet exist. Consequently, the CFO is required to negotiate increased credit limits with the banks.

If the payment readiness plan can be presented to the banks during negotiations for the granting of further loans or for increased credit limits, this increases the chances of success and may help to negotiate more favorable conditions.

However, ensuring solvency at all times must also be taken into account when considering strategic plans with a multi-year horizon. This is because the necessary means of payment depend on the investments, cash-effective costs and net revenues generated by strategic decisions.

Investments in success potentials (mainly additional project costs), inventories and equipment may have to be paid several years in advance, before the sales to be generated lead to cash returns. This requires sufficient cash inflow from owners and usually increased credit limits from banks.

A readiness-to-pay budget on a multi-year basis is sufficient in this case, since the exact payment dates are not known. To prepare this budget, the expected effects of the strategic plans must be reflected in the medium-term planning. These are sales developments, product costs, cost center and, above all, project costs as well as (new) investments in fixed assets and inventories. In order to obtain reliable values, it is recommended that the process of cost center and project planning as well as product costing already be set up in the medium-term plan on a quantity and activity basis. From this, budgeted profit and loss accounts and budgeted balance sheets can be derived, which in turn find their way into the multi-year financial planning. This can be structured in much the same way as the above-mentioned payment plan. The columns then contain the plan years instead of the months.

With the procedure described, shareholders as well as the banks can see which major cash outflows are to be expected and when, and how long it will take until revenues lead to corresponding cash inflows. With this information, management’s prospects of obtaining financing for the planned development on time and on good terms with additional equity and new credit lines increase. Since uncertainties remain despite planning, credit limits with large reserves must always be negotiated.

Overall, it can be seen that volume and performance-based planning is also a central prerequisite for managing the top-control “Liquidity”. The prerequisites for this are created with the holistic management control system. In the book “Management Control System” and in its simulation model, the structure of the required system is described and illustrated, primarily in chapters 4 and 10.

Essential key figures for assessing the liquidity situation are described in the “Controller’s Guide” in chapter 7.3.