Market position and company size

A good market position of a supplier corresponds to a high probability that his offer will win the bid against other offers which the customer also considers in his purchase decision.

Strictly speaking, market position is first a property of a single offer.

In businesses that make only a few offers with high sales volumes, such as the capital goods business, it may make sense to evaluate the market position of a single offer. In most cases, however, the market position is described statistically, e.g. for certain time periods, for similar customer segments or for similar product groups. For this purpose, absolute and relative market shares are determined (cf. the examples of market share determination in the post “Market Position”). However, a pure market share analysis – whether absolute or relative – is not sufficient for a strategic understanding of market position.

Relative market share

If the customer buys from one competitor and not from the others, this inevitably leads to a shift in relative market shares: One gains sales, all others stay where they were and thus lose relative to the winner. The change in relative market shares, in turn, correlates strongly with absolute variables such as sales volume, number of employees, etc. However, the correlation is not compelling. In declining markets, for example, it is possible to gain relative market share and still have to record declining sales.

Size is important for relative market share, but not always

From a management point of view, the following is essential: The probability that customers will buy from one company and not from another is, in principle, completely independent of the current size of the competitors. If, for example, a clever individual creates (and patents) a new, superior solution to an existing customer problem, this individual can quickly improve his market position compared to a large corporation that only offers the outdated solution.

Accordingly, size is an unfortunately not guaranteed, but nevertheless probable consequence of a good market position. In other words: The market position predetermines growth and thus future sales volume. Thus, it can be assumed that the group in question had a strong market position in the past and is therefore large today. If the group does not succeed in bringing its market position, which has come under pressure, back into shape through innovation, it will lose size, while the individual – if he does everything right and is also a little lucky – may become the large group of tomorrow.

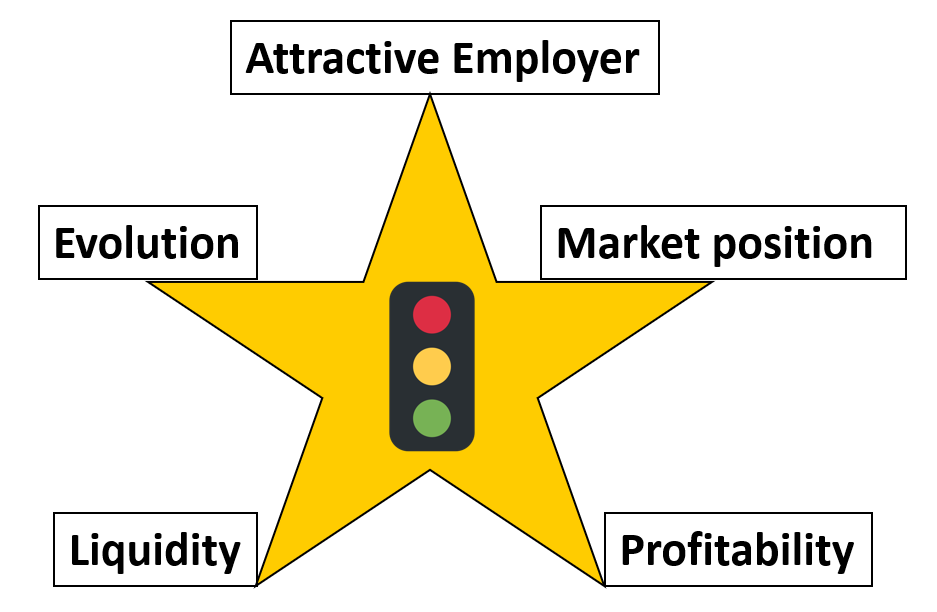

There are interdependencies between market position and company size. For example, the limited production capacity of the individual can have a negative impact on his market position. If extensive, interwoven structures hinder consistent responsibilities or adequate adaptation to changing market conditions, size can also have a negative impact on market position. It is essential that managers clearly distinguish between market position and size: On the one hand, operational result variables such as sales, sales growth, absolute market shares and liquidity are considered. On the other hand, internal piloting variables and relative market shares are decisive for the market position.

To be able to state the position of a vendor “in the market”, it is of course first necessary to outline which market is to be analyzed. It is often the case that companies have a good market position locally. If, however, customers consider not only local offerings but also those of global players, the position in the global market must also be included in the strategic assessment. After all, it is of no use to the local champion if local customers prefer to buy from international players. In the end only one gets the definitive contract – all other competitors can only book costs, but no sales.

Market is a set of purchasing decisions

“The market” must not only be defined geographically. At its core, it is about buying decisions that have a different structure. For example, one can have a good market position with existing customers, but a poor one with new customers. Seen from the customer perspective, market is a set of purchasing decisions that are similarly structured. Customer benefit analysis helps to analyze the situation clearly.