Improve Productivity

An organization becomes more productive if it succeeds in increasing its output while either keeping the input the same or, even better, reducing it. In the post “Profitability“, the measurement of productivity ratios was explained. These entail dividing output by the inputs consumed;the change in these ratios over time should be tracked. In the example of the mentioned post, a labor productivity increase of 11.11% was calculated by dividing the units sold (units of output) by the complete labor hours used by the company (hours of input). However, this ratio is of limited use for planning and controlling the company as it does not indicate which processes have become more productive and by how much. Productivity metrics are needed at the cost centers and process level as many sub-processes need to be continuously improved.

It is difficult to measure productivity development in smaller units, e.g. individual cost centers or processes. This is because improvements are to be achieved there first. In manufacturing it is possible to see whether processing times for a particular item in a cost center are decreasing over time by evaluating order-related activity recording. But to measure productivity improvements in internal processes and cost centers is tricky as often the output measure cannot be clearly delineated, because the activities of different cost centers contribute to the output and because their work effort is not (or cannot be) measured.

Example 1: Ticket answering in IT

Many data centers have set up ticket systems to process and respond to error messages or requests from system users. The output of such ticket systems is answered requests from system users. In order to measure output, it is necessary to define what is to be considered as a response and thus as an output (i.e. problem solved, systems running again or only the explanation of why the error occurred and how it can be avoided in the future).

The input measurement requires further determinations:

-

- What work times to fix the error are to be measured? (The processing time of the assigned IT employee, of all parties involved, or even that for external support?)

- Are the speed of response and the time to complete problem resolution also to be measured? If so, how are they weighted?

- Are financial inputs also to be included, such as invoices from third parties, higher royalties, or depreciation? If so, the inputs must be equated, which can only be done using monetary values.

Example 2: Productivity in personnel administration

It is possible to determine whether the average number of hours required for the salary administration of an employee decreases over time: output = 1,000 salary receivers, input 30,000 hours p.a., i.e. 30 hours per person per annum. If an employee of the warehouse retires and is not replaced, 30 hours should be saved in the HR department per year. Only if in HR less than 29,970 hours are consumed has productivity of salary administration increased.

This means that the outputs and the inputs of the personnel department are to be differentiated, in order to gain deeper insight into the changes in productivity of their processes. How much working time is used for:

-

- Recruiting and hiring employees

- Recording and maintaining employee data including performance appraisal documentation

- Payroll accounting, social insurances, settlements with third parties

- Supervision of internal and external training and further education

- Planning and execution of internal training events Coordination with works council and trade unions?

Example 3: Recording of sales order data and packaging for delivery

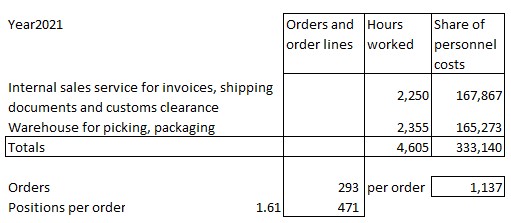

In the example company Ringbook Ltd. the productivity of sales order processing and of collecting and packaging the delivery for the customers should be increased. The costs of transporting the goods to the customer are not taken into account, since the delivery is carried out by external companies (post office, delivery service, transporting company) and invoiced to the customers according to the transportation price list. Only the personnel costs for these operations are considered. The analysis resulted in the following values:

In fiscal year 2021, 293 customer orders were processed with a total of 471 order positions. According to service recording (recording of hours used for internal tasks), see the post on internal tasks , 2,250 hours were worked in the sales department and 2,355 hours in the warehouse for the preparing and packaging of the positions sold. These hours were multiplied by the weighted hourly presence rate of the employees involved. This resulted in the personnel costs of the packaging, shipping and invoicing process of 333,140 EUR. On average, the processing of a sales order consumes 4,605 hours divided by 293 orders = 15.72 hours, resulting in personnel costs of 1,137 EUR.

The productivity of the invoicing and delivery process thus improves if the average personnel costs per sales order can be reduced below 1,173 EUR.

Measuring working times for internal tasks

The three examples show that productivity improvements must be sought and identified primarily in the individual cost centers and in cross-cost center processes. To this end, time consumption for processes must be measured first and foremost, which is particularly difficult in areas not directly related to production.

It is necessary to be able to conclusively identify the contents and results encompassed by a process. Additionally the recording of activities must be structured in such a way that the work performed can be recorded according to these delimitations and that linked work steps of other cost centers can also be recorded, e.g., the working time of the production data management in order to be able to trigger and track a production order.

To evaluate ideas for productivity improvement, it is necessary to be able to measure or at least estimate consumption, especially of employee hours. With this in mind, planning and recording consumption for internal tasks will be covered in more depth later in this blog.

Investments for productivity increases

When looking for productivity improvements, often the question arises as to whether individual tasks should be outsourced to another company or whether investments in hardware, software or automation might be worthwhile. In such cases, Dynamic Capital Budgeting proves to be an effective means of quantifying process-related changes. This is because it can also include investments and changes in consumption of material and worktime. Cost savings are compared with the investment amounts and the expenditures for external services, and their effects are quantified for the planned useful life of the project.

More details in the post “Dynamic Capital Budgeting” (will be published Jan.3rd 2023)