Market Position

A company must continually find enough customers to buy (and pay for) its products and services. This requires a strong and expandable position in the market. Market position is the position that a company’s own product, assortment or even an entire company has in comparison to the offers of its competitors from the perspective of existing and potential customers.

Market Share

The most common way to assess market position is to measure market share. However, this is difficult because it is often unclear which market area is relevant for observation, which are the competing suppliers in this area and how much they sell (volumes and values).

The absolute market share is calculated by dividing one’s own sales in the area by the sales total of all suppliers.

Example of a local bicycle dealer

Own sales in the relevant area divided by sales of all bicycle dealers in the same area.

Often, the sales and turnover achieved by others cannot be collected or are only known with a delay. This makes planning more difficult and requires estimates. Good estimates are usually sufficient for strategic planning to determine the offer and the intended sales prices.

Because sales and turnover data are often lacking and above all the comparison with the largest competitors is sought, the relative market share is also calculated:

Own sales divided by sales of the largest or the three largest competitors in the same area.

The relevant data can usually be obtained from the annual reports of the market leaders.

Market share estimates are important for strategic decisions.

Large-scale statistical analyses by the Strategic Planning Institute SPI showed that market leaders achieve higher profitability in real terms (return on sales ROS) than suppliers with lower market shares (cf. The PIMS Program, Strategies and Corporate Success, by R.D. Buzzell and T. Gale, Wiesbaden 1989). Even though these evaluations are a bit dated, the relationships are still valid. This can be explained by the fact that market leaders can spread their fixed costs over more units sold than smaller suppliers. In addition, the optimization of their bills of materials, routings and batch sizes has an effect on larger production volumes, which also reduces proportional unit costs faster than those of smaller competitors (more automation, less scrap, lower setup costs).

Market share rank and profitability

The interaction of the factors listed leads to significantly higher sales profitability (Return on Sales) for the market leaders than for the suppliers with lower market shares. Especially in mature markets, the higher profitability leads to the market leaders taking over the smaller competitors with the money they have earned, resulting in higher concentration. Notice that the customers rank the product quality of the market leaders higher than the quality of the followers.

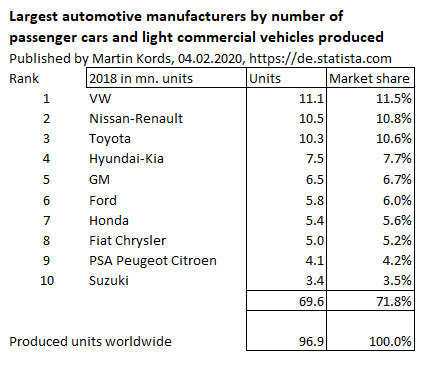

The example of the automotive industry illustrates this development:

In the meantime, Fiat-Chrysler and PSA have also merged to Stellantis. In addition, PSA has acquired Opel and Vauxhall from General Motors. The new group is estimated to produce about 8.7 million automobiles annually, ranking 4th in the world.

Large market shares also mean market power in setting technical standards and selling prices. Some examples:

-

- Operating systems for Personal Computers: Microsoft Windows has a market share of about 85%, Apple’s MAC OS about 18%, Android increasing (praxistipps.chip.de)

- Cancer drugs: Roche, Pfizer, Johnson and Johnson (statista.com)

- Internet search engines: Google (92%), Yahoo (2.7%), Bing (2.4%), Baidu (in China 64.5%) (indexlift.com)

In the strategy development process, it is therefore necessary to compare one’s own market position with that of the market leaders in the intended offering area. This applies to a small local business as well as to large corporations. The market analysis must reveal which are the decisive providers in the catchment area and with which offers they achieve the greatest success.

As shown above, market position also has a significant influence on unit costs. The larger the market share, the greater the chances of achieving more favorable average unit costs than competitors. To penetrate these relationships, some posts on the experience curve will also be published in this blog.

Customer Value

It is important to achieve a significant market position in the served market and, in the eyes of the (potential) customers, a higher relative product quality. With a strong market position the average cost per unit should sink in the medium term. This is one of the reasons why market leaders can become more profitable.