ROI and Inflation

The ratio Return On Investment ROI is defined as:

Profit before deduction of taxes and interest (EBIT) : invested assets.

EBIT (100) / Balance sheet total (1,000) = ROI (10%)

The financing structure, i.e. the shares of debt and equity on the balance sheet total, is therefore not taken into account. This enables the profitability comparison between different companies even if they have different financing structures.

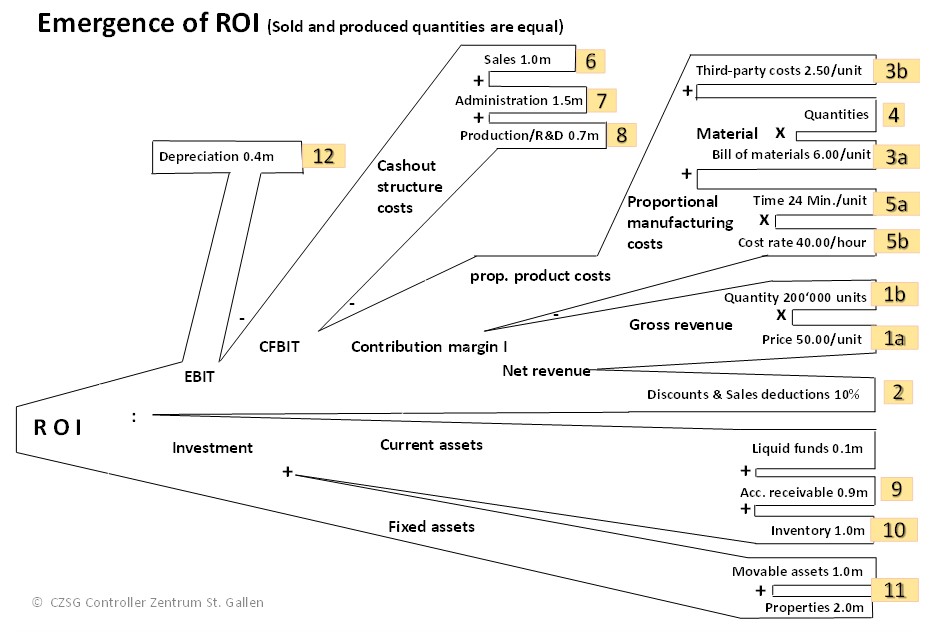

If the revenue and cost sides of a company are broken down into their main components, it is possible to see which items affect ROI and to what extent. We call this representation the “ROI tree”.

In the example, 200,000 units were sold at a gross price of 50.- per unit. This corresponded to the gross revenue of 10.0 million. 10% discounts and other sales deductions were deducted from this, resulting in net revenue of 9.0 million (1a, 1b, 2).

The direct material and unit-related external service costs amounted to 8.50 per unit (3a, 3b, 4). Manufacturing consumed 24 minutes per piece, which at the rate of 40.00 per hour resulted in a proportional manufacturing cost of 16.00 per piece. Multiplied by the production quantity of 200,000 pieces, the proportional production costs were 4.9 million (5a,5b).

This resulted in a contribution margin I (CM I) of 4.1 million.

CM I was used to cover the fixed cost center costs of the functional areas (6, 7, 8), which resulted in a cash flow before deduction of interest and taxes of 0.9 million. After deducting imputed depreciation and amortization of 0.4 million, the profit before interest and taxes (EBIT) was 0.5 million.

Dividing the EBIT of 0.5 million by the assets invested in the period of 5.0 million (9, 10, 11) gives the ROI of 10% in the year under review.

Effects of inflation

-

- If the suppliers of materials and external services increase prices by 5%, this results in a cost increase of 0.085 million for the company. The graph shows that this amount has a direct impact on EBIT and thus also on ROI. See also the post “Purchase Price Variances are topical again”).

- In the same way, price increases for auxiliary materials and purchased services have an impact on the cost centers. This affects the production centers (5a, 5b) as well as the cost centers of the other functional areas (6, 7, 8).

- If machines, buildings, equipment and intangible goods become more expensive, the imputed depreciation increases as a consequence, which again lowers EBIT and thus ROI (12).

- Another consequence of inflation is that employees lose purchasing power. They will demand – somewhat delayed – higher wages (5b, 6, 7, 8).

- On the left side of the balance sheet, inflation also leads to higher invested assets.

- If inventory levels remain the same, the average value of the stock will rise (10).

Banks will raise interest rates on loans, which will reduce pre-tax profits. In the end, business owners (partners, shareholders) will also demand higher dividends because the purchasing power of their dividend income will also decrease.

Conclusion: Inflation is a vicious circle that must be broken by all means. In the private sphere, renunciation must be practiced in order to cope with disposable income and assets. In the corporate sector, attempts must be made to push through price increases. In doing so, there is always the risk that customers will jump to other suppliers, resulting in a drop in sales. Even more important is to strive to improve efficiency in all areas, i.e. to break the vicious circle through more cost-effective processes and structures.

Starting points for improving efficiency are the subject of the next post.