Simulation models

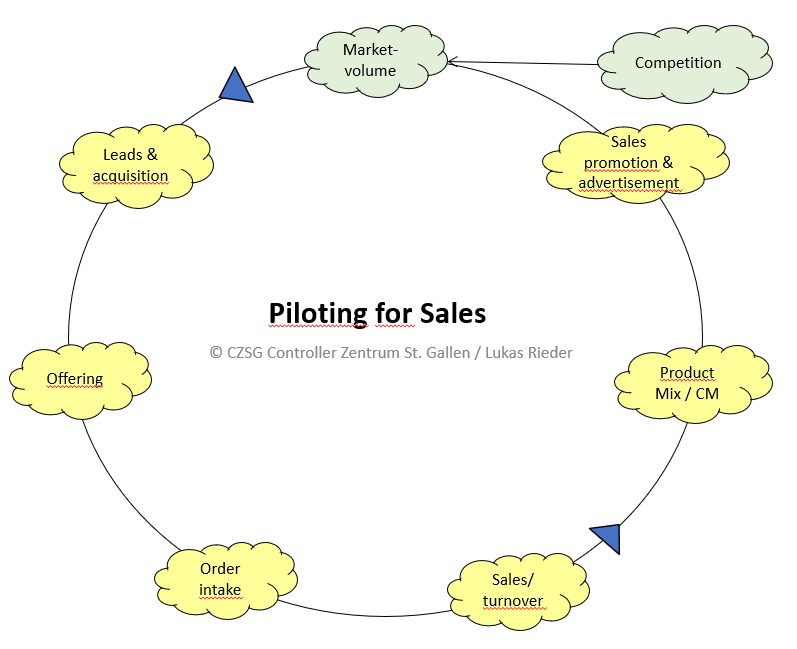

In simulations the chances of a decision are compared to its possible risks, quantified and evaluated. Users of simulation models are primarily the decision-making executives. Since decisions can only be made for the future, assumptions are first made regarding quantities, times and values to be achieved.

In order to increase the reliability of decision-making, as much reliable knowledge as possible should be incorporated into the simulations, i.e. previously realized quantities and net sales prices as well as actual costs. This can be sales volumes and net sales revenues realized with previous customers as well as the proportional and fixed costs incurred for these. A management accounting system provides this data if it meets the requirements described in the post “10 principles for Decision Relevance“.

-

- If new customers are to be won with the existing services and products, it must be estimated what additional contribution margins are to be won with these new customers and whether new investments or higher fixed costs are to be expected for this growth. The additional contribution margins to be generated must at least cover the delta of fixed costs plus the delta of imputed depreciation from the investments.

- If new products are to be added to the range, it must be estimated how much additional contribution margin can be generated by this expansion and whether this will be able to cover the additional fixed costs (including change in imputed depreciation) that have also been estimated.

- If investments in information technology are to reduce the costs of planning and handling internal processes and documentation, it is necessary on one hand to estimate which cost center costs leading to cash outflows can be reduced and to what extent, and on the other hand which investments will be required for this and during how many years these investments can be used.

Is a campaign to win new customers worthwhile?

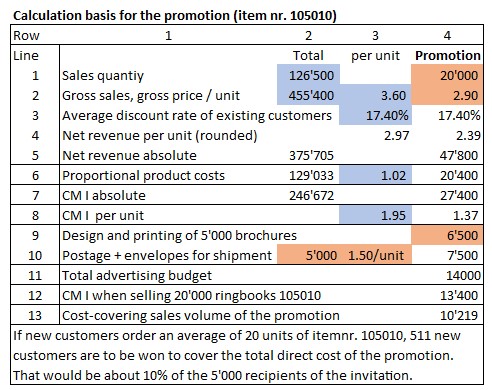

The sales management of Ringbook Ltd. is considering a campaign to acquire additional customers. From November to January, then when the filing cabinets for the following year are labeled in the companies, potential new customers are to be contacted. Article 105010, the standard ring binder for filing, is to be offered in this canpaign at the gross special price of 2.90 instead of 3.60 (approximately 20% discount). In the advertising brochure however the offers for customized ring-binders are to stand in the foreground. At Ringbook Ltd. these products generate higher contribution margins per unit than the standard products.

It is planned to produce and stock an additional 20’000 units of ring-binder 105010 after the summer break. For the advertising campaign (letters and emails), a budget of 14’000 EUR is planned for brochures (design and printing) as well as envelopes and postage. 5’000 potential customers are to be contacted. The internal sales department will pack and mail the brochures. Should this advertising campaign be carried out?

Structure of the simulation model

The simulation model should be able to show how changes in the key values could affect the financial success of the promotion. Key values are:

-

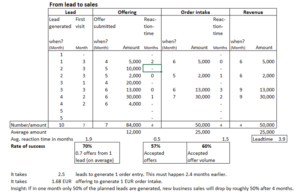

- How many potential new customers should be contacted, what proportion of them will order how many pieces of article 105010?

- How many items sold at the special promotion price are needed to cover the costs of the promotion?

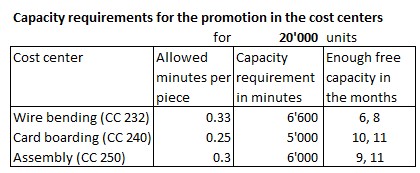

- Are the personnel and machine capacities available to produce the planned quantities on time? Will this require working hours with shift allowances?

- Can the existing internal sales staff perform the work for the promotion or are higher than planned personnel costs necessary for this?

Relevant for the decision are the assumptions made by the managers and existing data from the planning and control system of Ringbook Ltd. (see Management Control System, integrated planning and control and the simulation model contained therein).

The red fields are the preliminary assumptions of the managers, the blue fields contain the initial data from the simulation model of Ringbook Ltd.

Columns 1 – 3 contain the calculation basis:

-

- Gross sales divided by sales volume gives the applicable gross sales price of 3.60

- The 17.4% is the average discount rate granted to existing customers based on their customer group membership. This gives the net revenue of 375’705 in line 5, column 2.

- The proportional product cost per unit 105010 of 1.02 also comes from the simulation model.

- With this information, the CM I per unit and per period (246’672) is calculated.

In column 4, the key values of the planned action are linked to the initial data:

-

- Planned quantity, 20,000 pieces, gross sales price 2.90.

- The average discount rate of 17.4% is taken from the annual planning, as well as the proportional manufacturing costs of 1.02 per piece.

- If the planned 20’000 units can actually be sold as a result of the promotion, a CM I of 27’400 results. After deduction of the direct costs of the promotion (fixed) in lines 9 and 10, a profit improvement of 13’400 remains.

- Due to the special discount, the CM I per unit decreases from 1.95 to 1.37. This means that the promotion is profitable if more than 10’219 units are sold at the promotional price (breakeven quantity of the promotion).

In the mentioned simulation model, the available and used capacities are also planned in minutes per cost center. From this evaluation, it can be seen that sufficient free capacity is expected to produce the 20’000 pieces for the promotion in the fall months:

Capacity requirements

The described action to attract new customers can be carried out. It is worthwhile if slightly more than 50% of the items 105010 produced for the promotion can be sold at the special price. The unsold pieces are still in stock at the end of January at proportional product costs. The chance of persuading new customers to order individually equipped ring binders is intact. Approximately 4 months after the end of the campaign, it should be assessed which new customers have been won and whether they have bought again.

Data basis for simulation models in management accounting

The quantification of planned promotions should show how the results (contribution margins, fixed costs, investments) are likely to change. The prerequisites for this must be created in the operational systems:

-

- In the resource planning system (ERP), it must be possible to plan material and working time consumption as well as capacities, sales and net revenues and to track them in actual terms.

- The management accounting system must be structured as a step-by-step and multidimensional contribution margin accounting system so that the proportional planned product costs and thus the contribution margins to be achieved can be calculated.

- The new investments to be expected must be taken into account. The previous depreciation costs are not relevant for the decision (sunk costs).