Countercurrent Principle

Anyone involved in the design of sustainable management systems automatically ends up with the question of whether to plan and control top-down or bottom-up. The answer is to proceed according to the countercurrent principle.

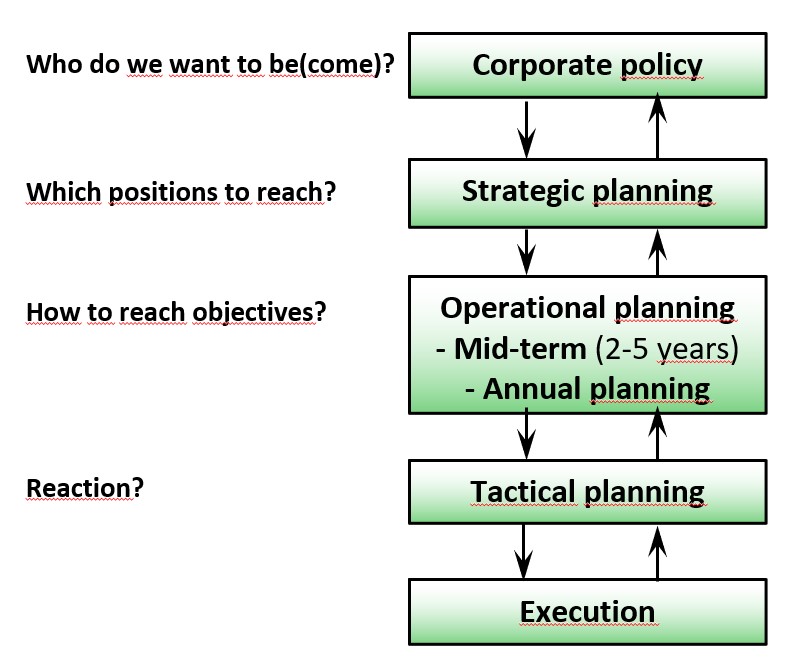

The post “The Main Questions of each Planning stage” shows that it is first necessary to answer what an organization wants to be or to become before implementation can be tackled. This determination is made by a small group of people, usually the owners. In corporate policy, they record their intentions regarding the markets to be served and the products or services to be provided for them. This is top-down leadership.

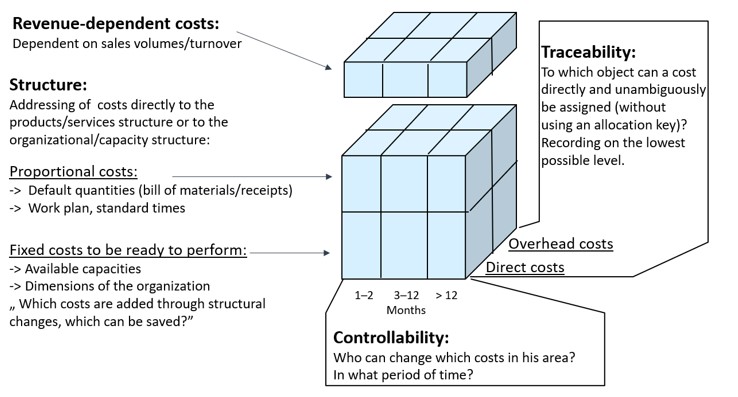

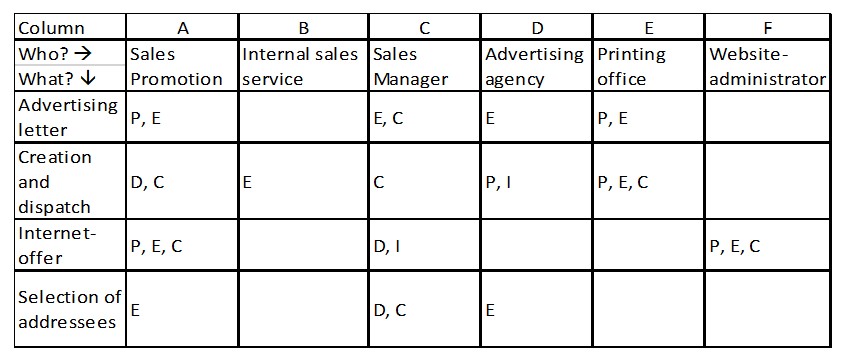

In strategic plans, the managers responsible for implementation specify which products and services they want to use to realize the corporate policy intentions in which markets (top-down). Before they can define the strategy, they have to make sure that the operating units of the company will be able to produce and sell the required products and services on time and in line with the market. To do this, they need feedback from the managers who will be responsible for implementation. The downstream managers assess from their operational perspective whether they have the personnel, factual, time and financial scope to implement the strategy operationally. This countercurrent assessment can lead to the adjustment of strategies. If this feedback is omitted or negated in decision making, there is a great risk that the strategies will cost more than they can deliver.

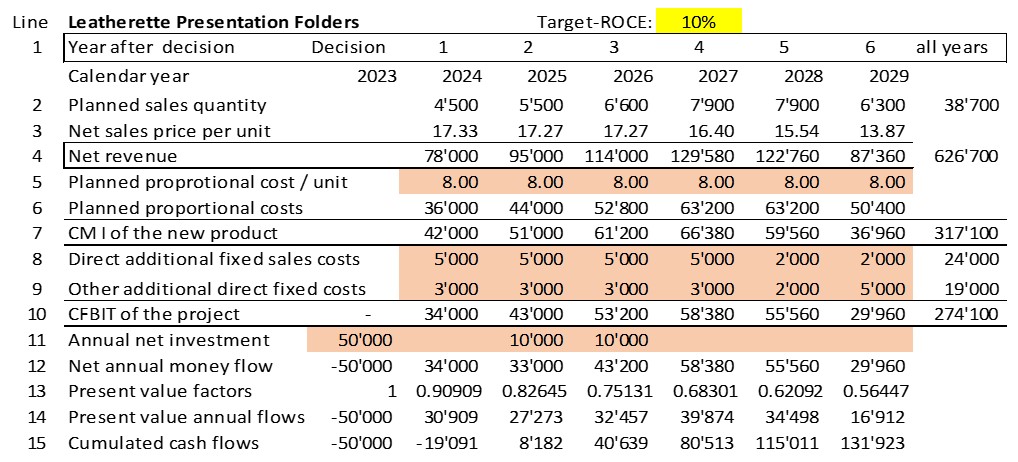

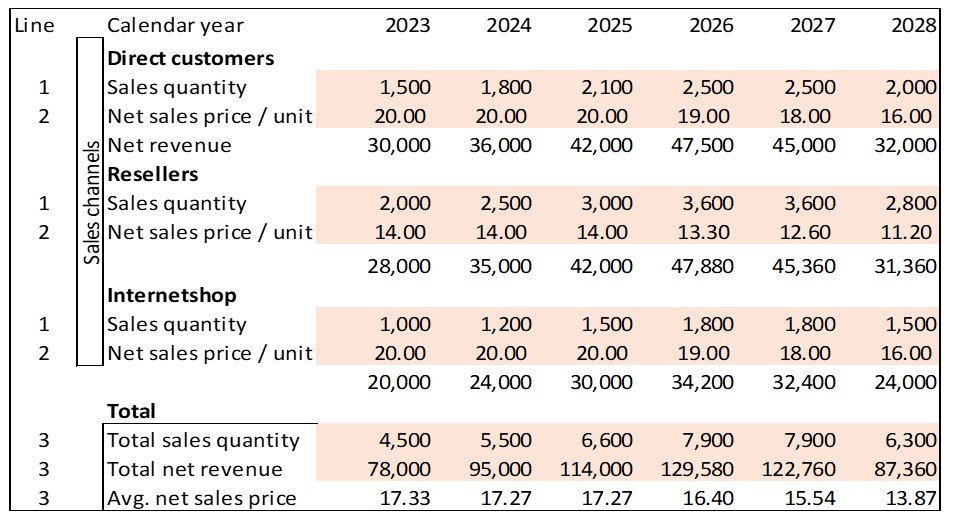

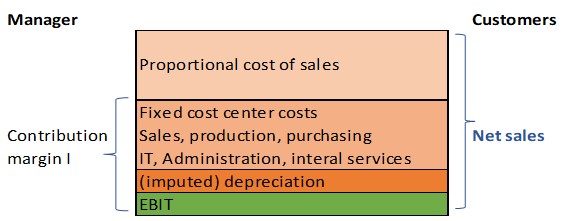

In operational planning and control, the feedforward and feedback loop is repeated. The available personnel, the existing facilities and the current processes must be able to handle the projects required for strategy implementation in a proper and timely manner, to bring in the necessary sales at net sales revenues in line with objectives and to keep within the planned fixed costs.

Reporting must be bottom-up because actual data on sales, production, personnel development, project progress and the like are prerequisites for determining the target achievement of the objectives in a period under review.

These reports cannot be neglected in the next planning round if realistic objectives are to be agreed. The counterflow of data and assessments of real implementation thus forms the indispensable bottom-up input for agreeing on the next objectives.

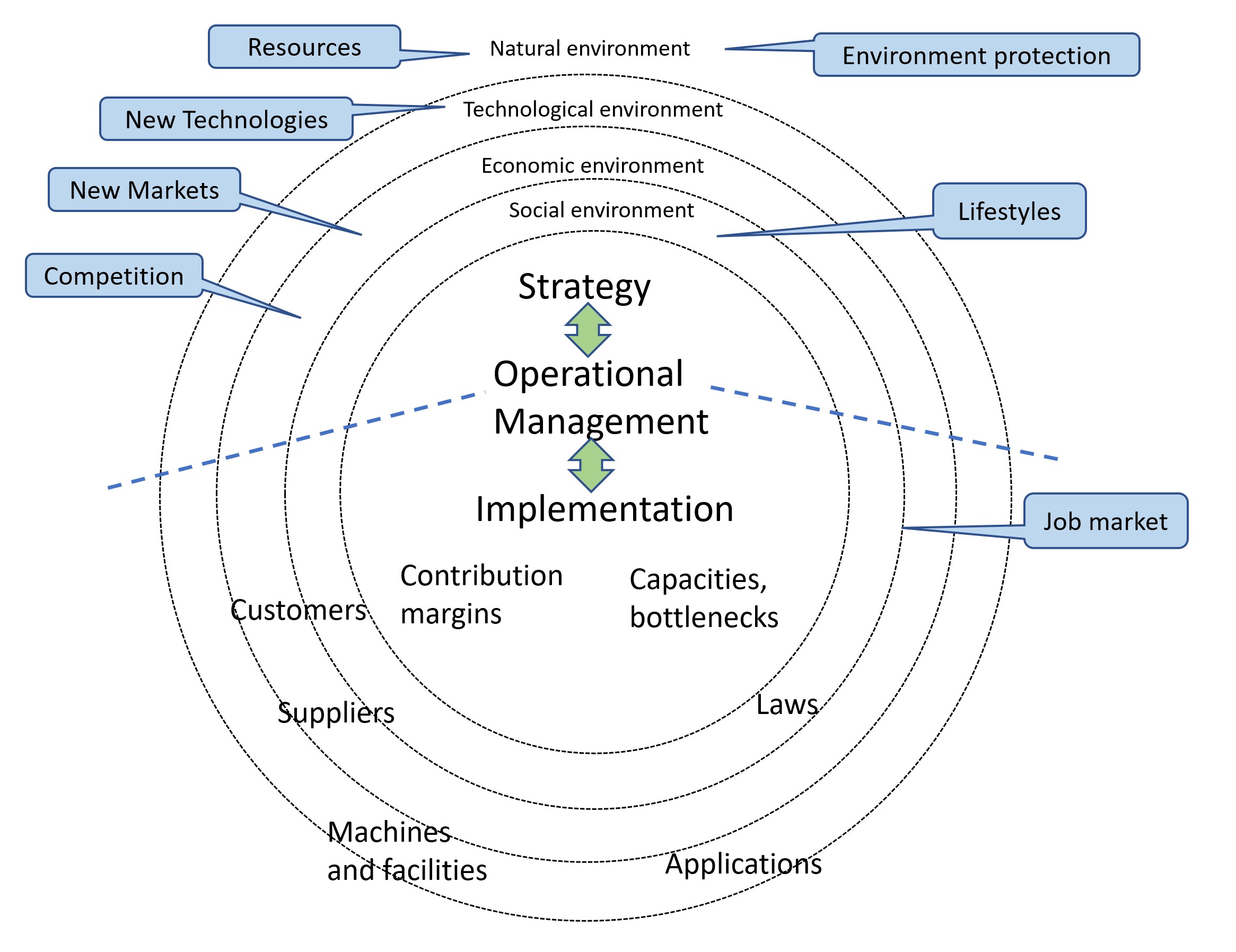

Another argument in favor of applying the countercurrent principle is that in strategic management, other, usually more uncertain data from the environmental spheres (cf. the post “Environmental Changes are Crucial for Management Control”), are collected and evaluated more than in operational planning and control. In addition, the time horizons are different. In the upper part of the figure below, the focus is on the internal success potentials required for strategy implementation. In the lower part, an assessment is made of how successful the implementation was and how the development of future success potentials went. This assessment may lead to the need to adjust the objectives for the next periods.

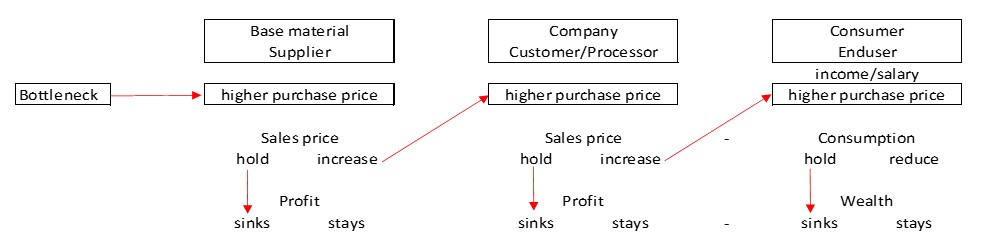

Conclusion: Planning top-down is a prerequisite for determining an organization’s future potential and realizing it on schedule. However, operational results, bottlenecks in manufacturing, delays in research and development, and customer and supplier bottlenecks or a dried-up labor market can lead to changes in operational and strategic goals. Feedback loops must therefore be built into the planning process. Committed employees often contributed ideas that led to the realignment of a company.

Agile team management is based on the assumption that teams act on their own responsibility. However, this does not mean that they can change their mission without considering the higher-level objectives (see “Prerequisites for Agile Team Management“).