Internal Tasks

The term “Internal Tasks” stands for all work to be performed in a company that is not directly caused by the units produced or by the activity of the receiving cost center. Internal tasks are only indirectly related to the products and services produced or sold. For better distinction we always write the term in our blogs with a capital “I”.

Examples of Internal tasks:

-

- Management, planning and control work in all areas

- Work of all sales-oriented cost centers

- The entire production planning and control as well as work preparation

- Work of personnel administration, payroll accounting and the time spent on training and further education

- Work of procurement, warehousing, forwarding

- Development and operation of the entire information technology as far as its services are not directly caused by orders from individual cost centers or customers.

- Work to keep buildings, company premises, installations and machines ready for operation

- Administrative work to comply with legal requirements.

All these Internal tasks have in common that they are rendered to keep the whole organization ready to perform. How much work capacity is built up and provided by employees or plant capacity is decided by managers as part of strategic and operational planning.

Planning hourly requirements for internal tasks

More than 50% of total personnel costs are incurred for Internal tasks in many industrial and service companies today. Therefore, the annual hourly requirements for these tasks must be planned and recorded in each cost center.

The difficulty lies in creating reliable capacity requirement plans for all Internal tasks. On the one hand, this is due to the fact that people in these areas perform a wide variety of tasks more or less in parallel. On the other hand, only a few companies record time consumption for Internal tasks. This makes it difficult to plan requirements.

To get a better grip on capacities and the cost block for Internal tasks, we recommend since years that the worked hours for Internal tasks should also be recorded by types of work. The presence time of a person can be measured quite easily using time recording devices but many managers are not even required to perform this recording for themselves. But just from recording the presence time it is not possible to evaluate for which task type how much time was spent.

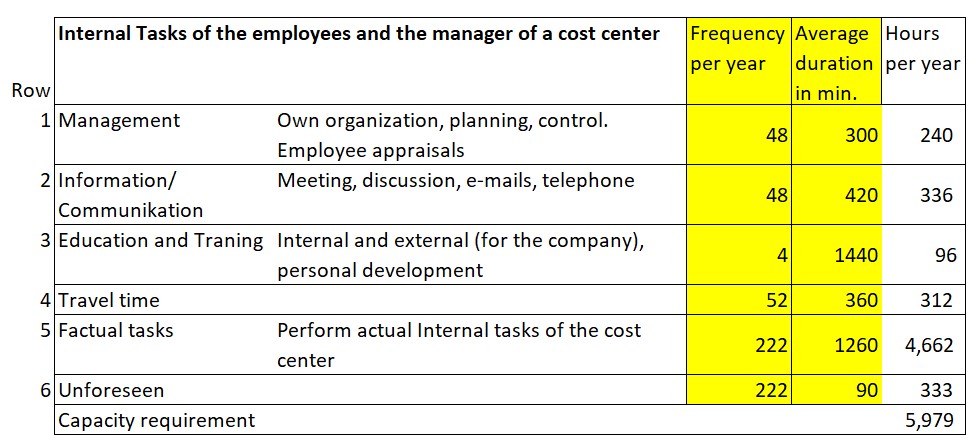

We made the experience that already the planning of the task types in the internal areas generates important insights for capacity planning. For this purpose, the Internal tasks are divided into six groups, which occur in almost every cost center:

For the factual tasks (Row 5) subgroups can be created in individual cost centers as needed. In the sales-related functions for example:

-

- Addressing potential customers

- Support of existing customers, preparation of offers

- Capacity requirement for contract negotiation.

In the human resources department subgroups could be:

-

- Recruitment and selection of personnel, payroll and social security

- personnel and sickness care

- Documentation of the potentials of managerial and professional staff.

Planning at this level of detail brings benefits to the whole company. Since employees are usually reluctant to record the time spent for different Internal tasks, a user-friendly and thus largely automated recording application must be set up.

Thanks to the lean production movement impressive improvements were already achieved in the area of directly product-related services and production management. Now it is time to apply the findings to Lean Administration as well (see the corresponding posts in the Lean Management area of this blog).